Donald Trump Revives Tariff Threats, Investors React Nervously

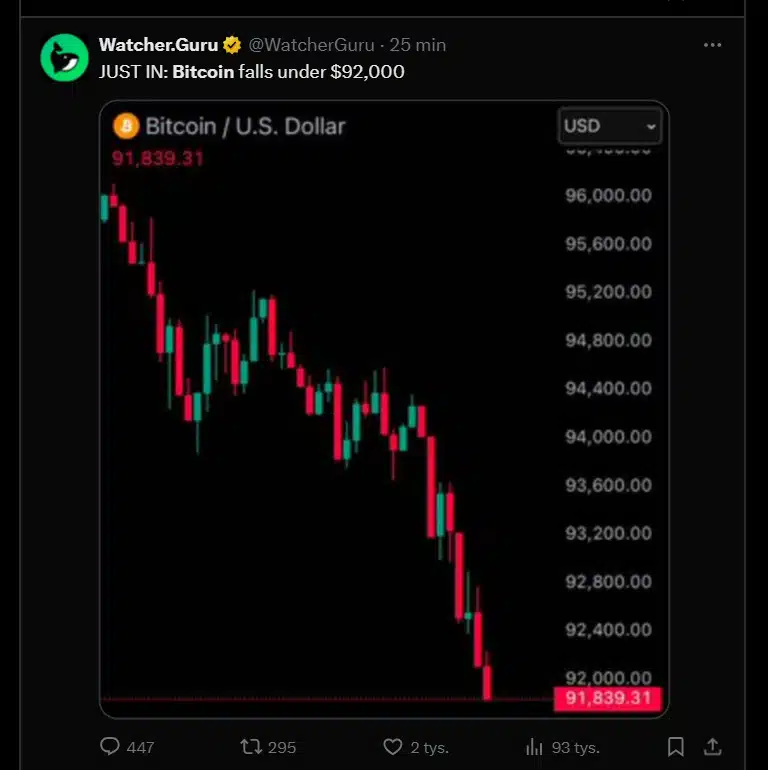

Bitcoin has dropped to $92,000, triggering a wave of panic across the cryptocurrency market. The main reason behind the sell-off is the continued correction on Wall Street, which started last Friday. Investor sentiment was further shaken by Donald Trump’s renewed threats to impose tariffs on Mexico and Canada. Notably, U.S. stock indexes closed last week with their worst session of the year.

Economic Uncertainty and Inflation Weigh on Financial Markets

Beyond trade policy concerns, risk aversion is rising amid persistent inflationary pressures in the U.S., which could influence the Federal Reserve’s next moves.

- Walmart’s stock plunged over 10% after the company issued cautious forecasts for 2025.

- Microsoft canceled several investment deals related to AI-powered data centers.

- U.S. bond yields surged, while a strengthening dollar is draining liquidity from financial markets.

Cryptocurrencies Under Pressure – Key Support Levels at Risk?

Since the start of the year, Bitcoin has lost nearly 2%, and its current price is 20% below its December all-time high. According to analysts at Glassnode, a further sell-off could push Bitcoin toward the $72K level if market sentiment deteriorates further.

Altcoins are also experiencing steep corrections:

- Ethereum has dropped over 10%, now trading at $2,500.

- Smaller cryptocurrencies are seeing even deeper losses.

Historical trends suggest that March 2025 could be a pivotal moment for the crypto market. However, many investors are still betting on the upcoming Bitcoin halving, which has historically preceded new price surges.

Will the market find support, or is a further downturn ahead? Much will depend on Friday’s U.S. inflation data and Nvidia’s earnings report, both of which could significantly impact investor sentiment.