Stock markets and cryptocurrencies are in sharp decline, driven by mounting concerns over the state of the U.S. economy. The S&P 500 just recorded its worst trading session since December 18, 2024, and investors are showing no signs of optimism. The fear of persistently high inflation in the U.S. is draining consumer purchasing power, raising speculation about a potential stagflation scenario that could ultimately lead to a full-blown recession.

Weak Economic Data Shakes Confidence

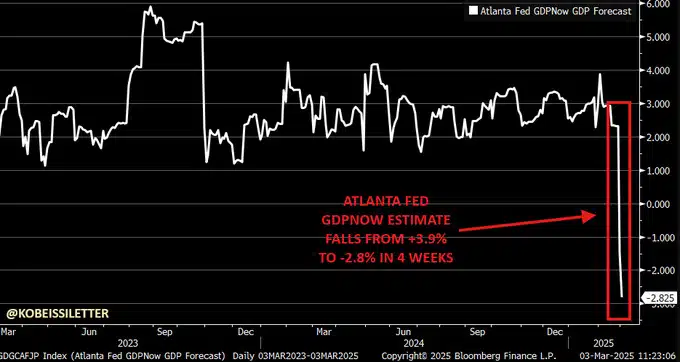

Following disappointing ISM manufacturing data, another shock came from the Atlanta Fed’s GDP forecast, which plummeted. Initially estimated at +3.9% growth, the outlook for Q1 2025 has now been slashed to -2.8%, marking a dramatic decline within just four weeks.

Adding to the turmoil, concerns are rising over trade tariffs, with Donald Trump’s proposed policies threatening to disrupt economic stability. If these tariffs are implemented at the projected levels, achieving a „soft landing” for the U.S. economy may become increasingly difficult.

Bitcoin and Crypto Market React Sharply

The cryptocurrency market took a hit following weekend turbulence. After an initial price surge driven by Trump’s announcement, digital assets plummeted just as quickly, wiping out all gains. Some analysts believe this could signal the end of Bitcoin’s bull market.

Speculation is also mounting that Trump’s inner circle may be strategically influencing the crypto market to drain liquidity from retail traders. On X (formerly Twitter), traders and analysts are increasingly voicing suspicions of market manipulation and insider trading linked to the administration’s policies.

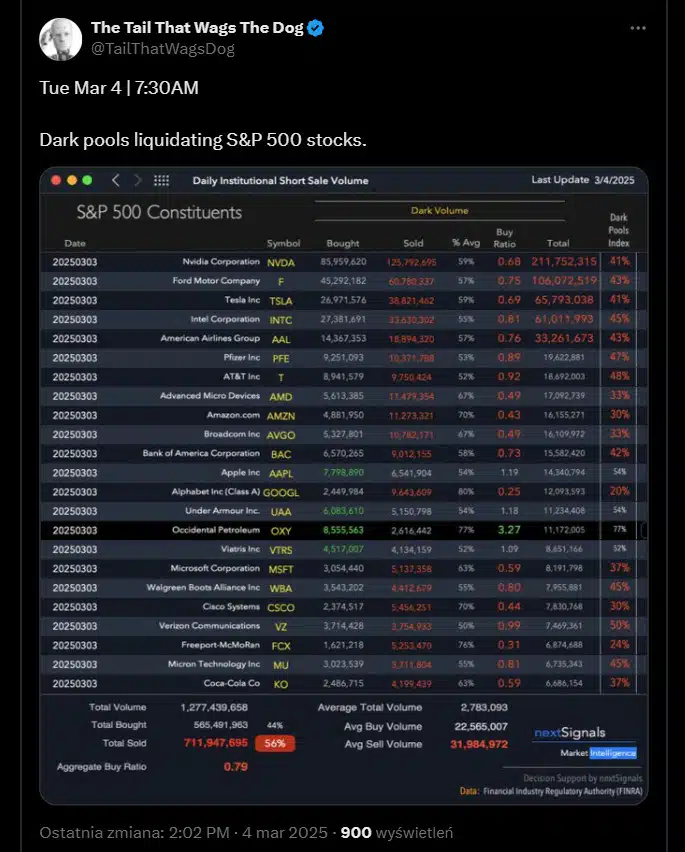

Stock Market Faces Widespread Sell-Off

It’s not just crypto that’s struggling—Wall Street is also feeling the heat. Interestingly, Tesla has been one of the biggest laggards in the S&P 500, with its stock plunging by around 30% since the start of 2025. Many tie this underperformance to escalating trade tensions and Elon Musk’s involvement in global economic shifts.

The semiconductor sector is also flashing warning signs. Only 11% of chipmakers listed on the S&P 500 are trading above their 200-day moving average, a level often considered the dividing line between bull and bear markets. Similar widespread declines were last seen during major downturns in 2018, 2020, and 2022.

Can the Market Recover?

At the moment, S&P 500 levels mirror those seen in September 2024, raising concerns about an extended downturn. U.S. Commerce Secretary Howard Lutnick has hinted that the Biden administration may reconsider tariff policies if countries targeted by trade restrictions ease fentanyl smuggling regulations. However, whether such adjustments will be enough to restore market confidence remains uncertain.

Final Thoughts

Both traditional markets and the crypto sector are facing significant headwinds. With fears of recession mounting and policy uncertainty shaking investor confidence, traders should prepare for continued volatility.

📢 What’s your take? Will the markets bounce back, or is this just the beginning of a deeper decline? Let us know in the comments!

🚀 Stay updated with the latest market news—follow us for real-time insights.

Thank you for reading!