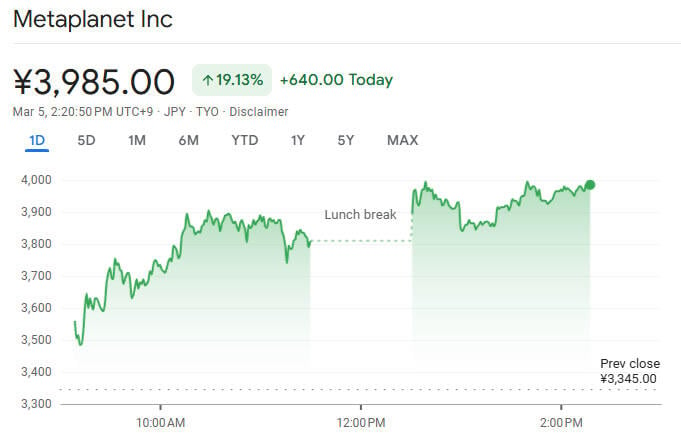

Japanese investment firm Metaplanet has made another bold move in the Bitcoin market, purchasing 497 BTC for $43.9 million at an average price of $88,448 per coin. Following this announcement, Metaplanet’s stock surged 19% on the Tokyo Stock Exchange, trading around 3,985 JPY ($26.60) as of March 5.

Metaplanet’s Expanding Bitcoin Holdings

- The latest purchase brings Metaplanet’s total Bitcoin holdings to 2,888 BTC, with an average buy price of $84,240 per coin.

- At current market prices, the company’s BTC stash is valued at approximately $251 million.

- CEO Simon Gerovich highlighted that Metaplanet has achieved a 45% year-to-date yield in 2025.

Bitcoin’s Recent Decline Creates Buying Opportunity

Bitcoin has been under pressure, dropping 8.5% in the past two weeks and hitting a three-month low of $79,000 on February 28. This downturn was fueled by fears of a potential trade war following Donald Trump’s tariff plans. However, Metaplanet took advantage of the dip to increase its holdings.

Metaplanet’s Aggressive Expansion Strategy

- The company acquired 156 BTC on March 3, marking its second large Bitcoin purchase this week.

- So far in Q1 2025, Metaplanet has accumulated 794.5 BTC, reporting $66 million in gains.

- The firm aims to acquire 21,000 BTC by 2026, positioning itself as a leader in Japan’s Bitcoin renaissance.

- Gerovich has also hinted at a potential stock listing outside Japan, possibly in the U.S.

Metaplanet Becomes Asia’s Largest Corporate Bitcoin Holder

With these latest purchases, Metaplanet has surpassed Hong Kong-based Boyaa Interactive International, making it the largest corporate Bitcoin holder in Asia and the 12th-largest globally, according to BiTBO.

Metaplanet’s bold Bitcoin strategy continues to fuel investor confidence, positioning the firm as a major player in the global digital asset market. 🚀