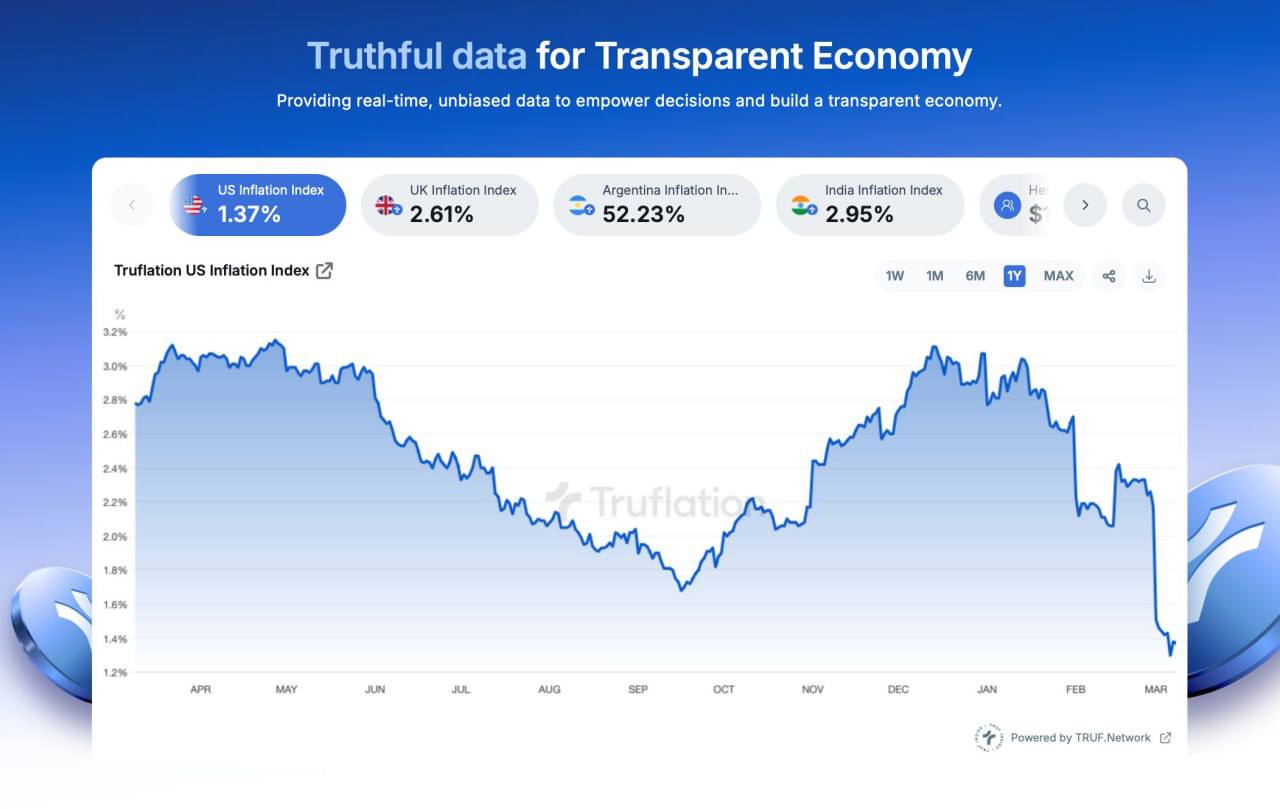

The latest data shows that U.S. inflation has fallen to 1.37%, significantly below the Federal Reserve’s 2% target. This sharp decline raises expectations for interest rate cuts, which could have a major impact on financial markets—especially crypto.

📉 What Does This Mean for the Fed?

- The Federal Reserve has maintained a tight monetary policy to combat inflation, but with inflation falling below target, the case for rate cuts becomes stronger.

- Lower interest rates typically lead to cheaper borrowing, more liquidity in the markets, and increased risk appetite among investors.

🚀 Why This Is Bullish for Crypto

- Lower interest rates = weaker USD, which often pushes investors toward alternative assets like Bitcoin and Ethereum.

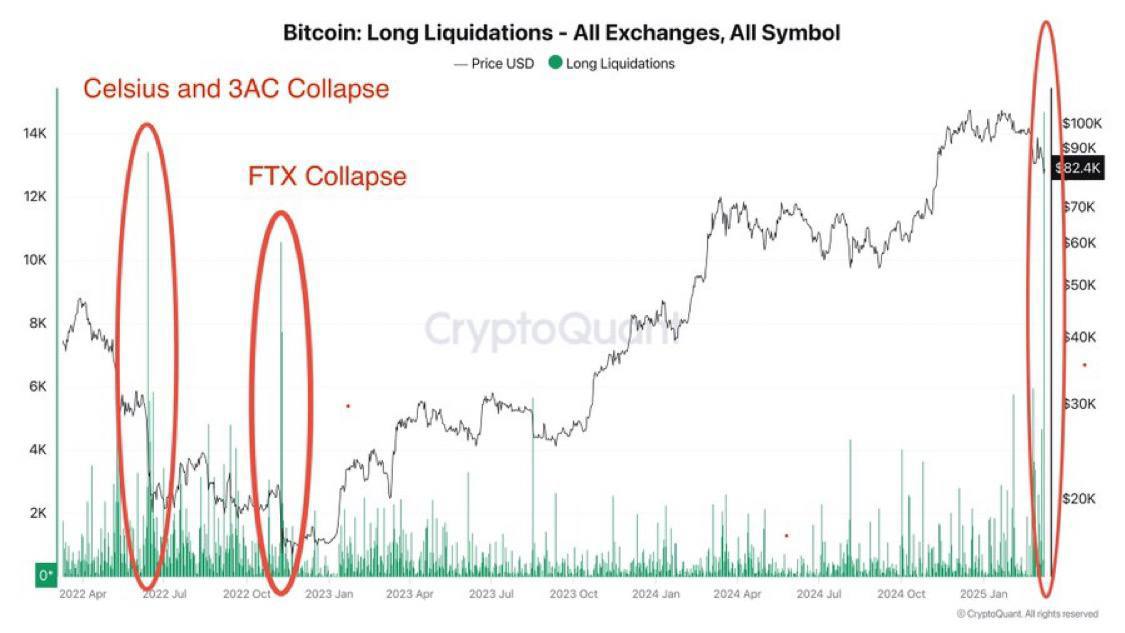

- Increased liquidity could fuel another rally in the crypto market, similar to previous cycles when the Fed eased monetary policy.

🔮 What’s Next?

- Will the Fed respond quickly with a rate cut, or will they wait for more data?

- How will Bitcoin and altcoins react to shifting macroeconomic conditions?

📢 Stay tuned as we monitor this critical economic shift and its impact on the crypto markets! 🚀