The cryptocurrency market has faced several tough weeks, but recent developments, including Donald Trump’s push for a U.S. Crypto Strategic Reserve, have created new dynamics. While some tokens stand to benefit, others—like Uniswap (UNI)—are in a more uncertain position as large volumes flood the market.

🔻 UNI Faces Selling Pressure

- Over the past two weeks, more than 5.2 million UNI tokens have been transferred to exchanges, signaling a potential sell-off.

- Historically, such large inflows increase supply, which—if not met with strong demand—can lead to price declines.

📉 UNI’s Recent Price Struggles

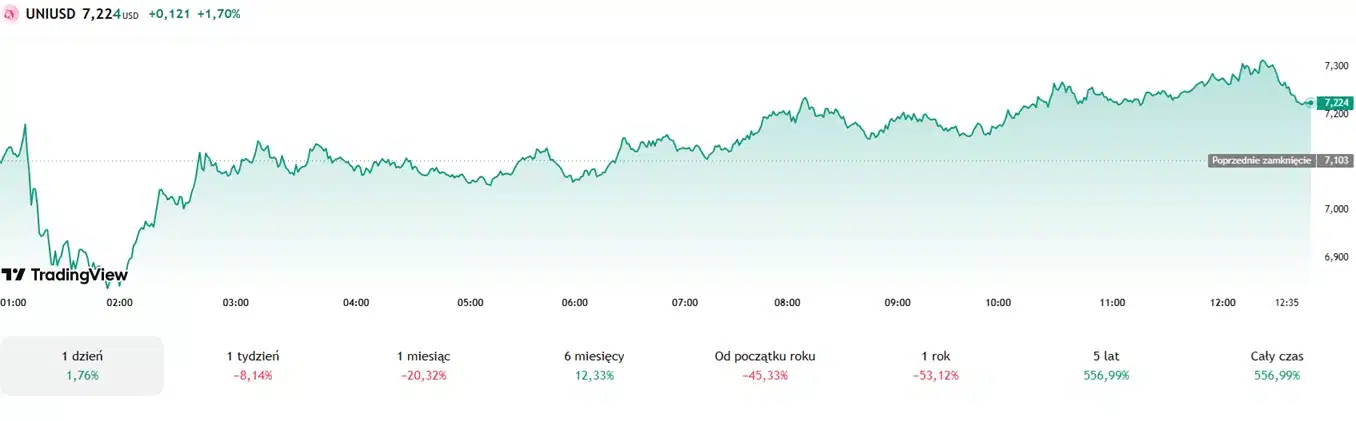

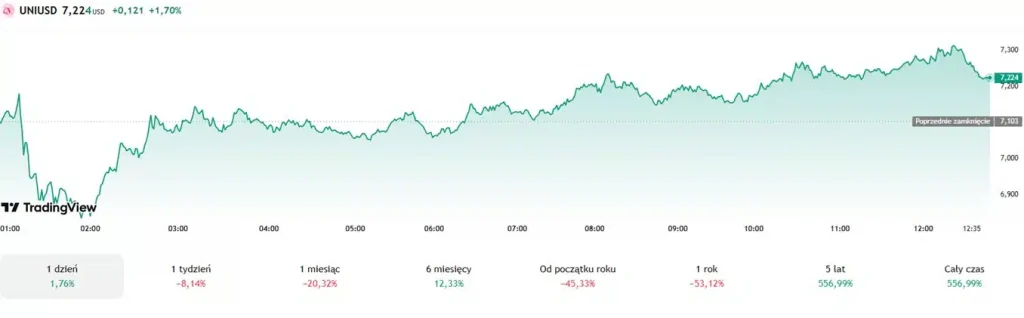

- At the time of writing, UNI is trading at $7.22, up 1.76% in the last 24 hours.

- However, the token has dropped 8.14% over the past week and is down 20.32% in the last month.

- TradingView indicators show strong sell signals, with oscillators and moving averages pointing toward further downside.

🚨 Will UNI Face Further Declines?

- As Trump’s crypto reserve prioritizes Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, and Cardano (ADA), investor focus may shift away from other tokens like UNI.

- If demand for UNI does not pick up soon, the token could face further losses.

📢 Stay tuned for more updates on UNI and the evolving crypto market trends!