Bitcoin (BTC) climbed back above $80,000 on Tuesday after a 3% drop the previous day. The decline was linked to outflows from U.S. Bitcoin ETFs, which saw $278.4 million in withdrawals on Monday. Investors are now awaiting key U.S. inflation data—CPI on Wednesday and PPI on Thursday—that could drive further market volatility.

Bitcoin Rebounds After Dropping to $76,606

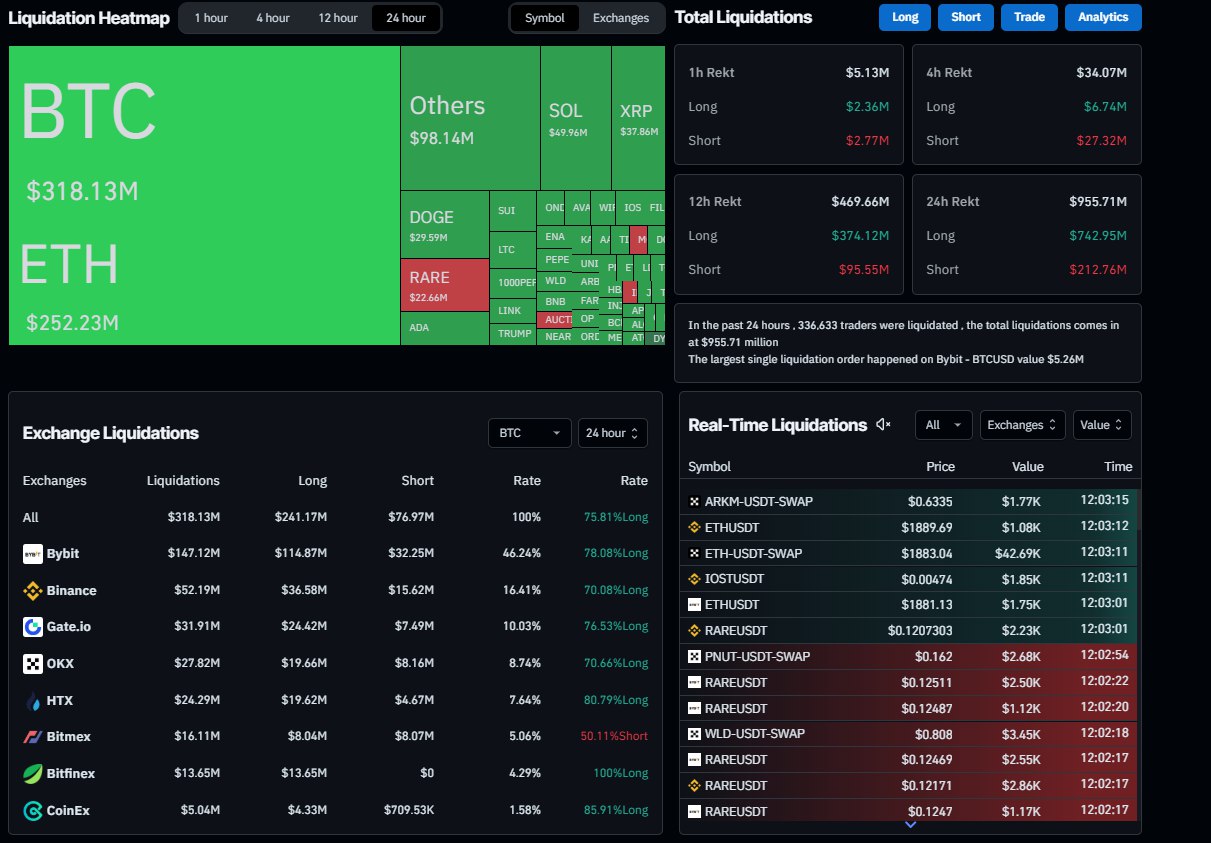

During Tuesday’s Asian session, Bitcoin hit a low of $76,606 before recovering above $80,000 in early European trading. In the past 24 hours, the crypto market witnessed $955.71 million in liquidations, including $318.13 million in BTC positions.

Agne Linge from WeFi notes that despite the rebound, investor sentiment remains cautious. Factors such as trade tensions between the U.S., China, Mexico, and Canada, along with persistent inflation pressures, continue to influence the market.

U.S. Macroeconomic Data and Its Impact on Bitcoin

A report from Bitfinex highlights ongoing economic uncertainty in the U.S. The labor market remains resilient, though the unemployment rate has edged up to 4.1%. Rising labor costs and inflation could shape the Federal Reserve’s future interest rate decisions.

Eren Sengezer from FXStreet points out that growing fears of an economic slowdown triggered a stock market sell-off earlier this week. Bitcoin’s next moves will likely depend on upcoming macroeconomic data, including CPI and PPI reports.

Weakening Institutional Demand for Bitcoin

According to Coinglass, U.S. Bitcoin ETFs experienced $739.2 million in outflows last week. If this trend continues, Bitcoin could face further downside pressure.

Additionally, the defunct exchange Mt. Gox transferred another 11,833.6 BTC (worth over $932 million), raising concerns about potential selling pressure in the market.

Bitcoin Price Outlook

Bitcoin has fallen below the 200-day moving average ($85,754), hitting a low of $76,606. The RSI indicator bounced off the 30 level, which could signal a slowdown in the downtrend. However, if BTC fails to reclaim $85,000, downward pressure may persist.

Key Takeaway

Bitcoin has rebounded above $80,000, but volatility remains high. ETF outflows, economic uncertainty, and upcoming inflation data will play a crucial role in determining the next price movement.