Key Highlights:

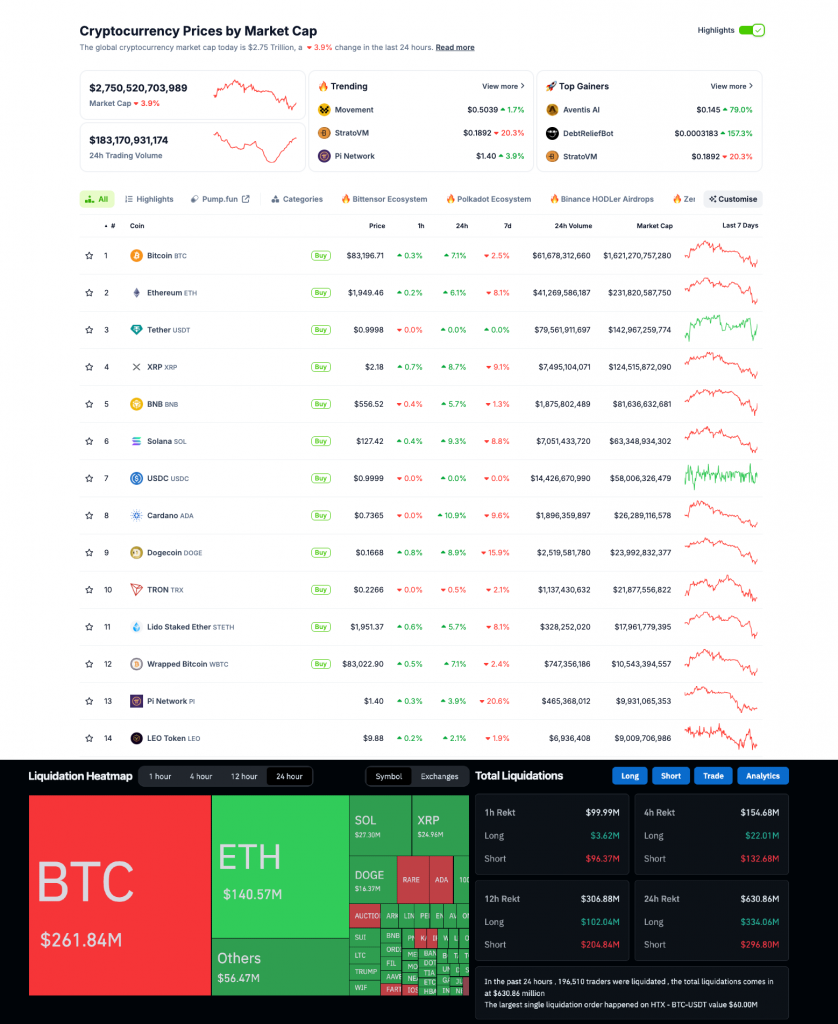

- The total crypto market cap drops 4%, falling to $2.75 trillion on Tuesday.

- Ethereum (ETH), Dogecoin (DOGE), and Chainlink (LINK) are among the biggest losers in the top 20 assets.

- A massive 11,335 BTC ($930M) transfer from Mt. Gox wallets triggered panic, raising fears of a potential sell-off.

- Bitcoin rebounds above $80,000 after a 15% drop in five days, signaling seller exhaustion.

Bitcoin – Market Update:

- Bitcoin’s price fell to $76,606, then rebounded 8% to $82,000.

- Mt. Gox-linked wallets moved 11,335 BTC, fueling concerns about selling pressure ahead of creditor repayments.

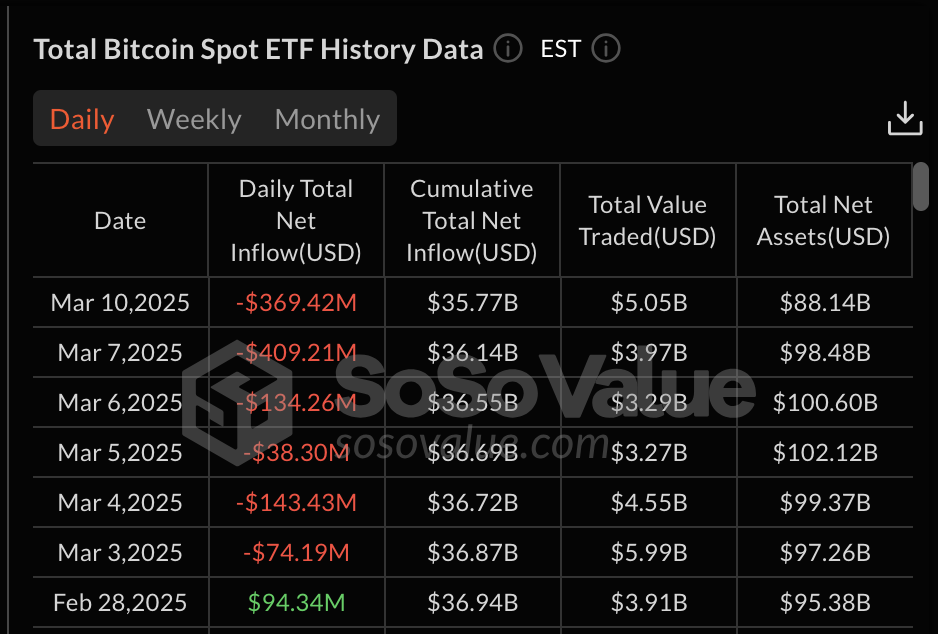

- Bitcoin ETFs saw $369M in outflows, marking the sixth consecutive day of withdrawals in March.

Altcoins – Mixed Signals in the Market:

- Cardano (ADA) jumped 10.9% to $0.7365, but $1.37M in long liquidations suggests potential retracement.

- XRP gained 8.7% to $2.18, yet strong short activity ($24.96M in liquidations) may limit further gains.

- Ethereum (ETH) rebounded 6.81% to $1,949, though $140M in liquidations indicates uncertainty about its direction.

Overall, the market saw $830.8M in liquidations over 24 hours, reflecting high volatility and the impact of leveraged positions.

Top Crypto News:

- Texas considers a $250M Bitcoin reserve – new legislation could allow state authorities to invest up to $10M in crypto.

- Tether (USDT) recognized as legal tender in Thailand – starting March 16, 2025, USDT will be allowed for regulated transactions and payments.

- Starknet plans to merge Bitcoin and Ethereum into a single Layer 2 solution – the new technology will enable Bitcoin’s use in DeFi and enhance its functionality.

Conclusion:

Crypto markets remain under pressure as Mt. Gox repayments loom, increasing volatility. Investors should watch whether Bitcoin holds $82,000 and whether selling pressure on altcoins eases.