Solana’s network revenue and total value locked (TVL) have plummeted over the past two months as memecoin trading activity cools off.

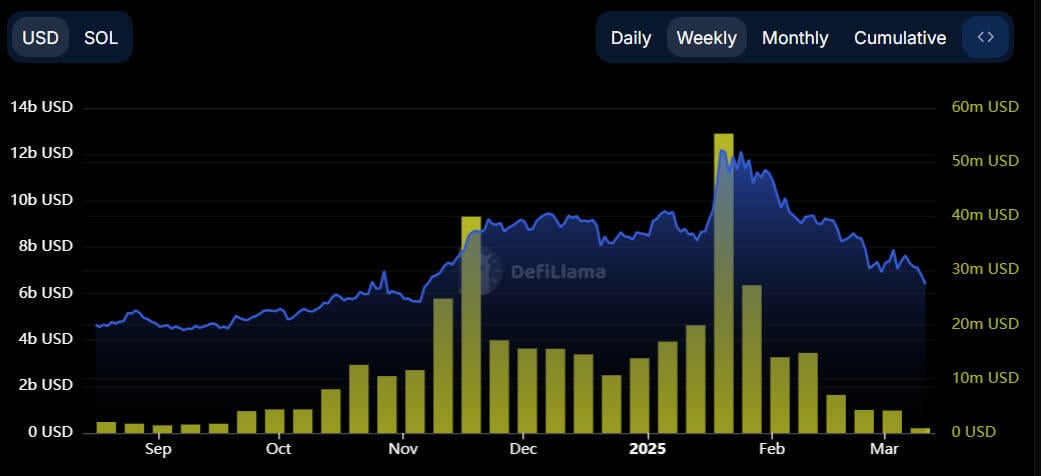

- Revenue Decline: Solana’s weekly network revenue peaked at $55.3 million in mid-January during the memecoin craze but has since dropped 93% to around $4 million last week, returning to September levels (DeFiLlama data).

- DApp Revenue: Weekly revenue from decentralized applications (DApps) on Solana also dropped 86%, from $238 million in January to $32 million last week.

- DeFi TVL Decline: Solana’s DeFi TVL fell nearly 50%, from $12 billion in January to around $6.4 billion now.

Memecoin Crash Drives Market Downturn

Memecoin trading, which made up 80% of Solana’s revenue (according to VanEck), has collapsed. The Pump.fun platform, a major hub for memecoin minting, saw daily revenue peak at $15 million in late January but has since fallen 95% to $800,000 as of March 7 (Dune Analytics).

Notably, Trump and Melania memecoins, launched in January, marked the peak of the memecoin hype. Their values have since nosedived:

- TRUMP token: Down 86%, trading at $10.50.

- MELANIA token: Down 95%, trading at $0.71.

The overall memecoin market cap peaked at $137 billion in December but has since dropped 68% to $44 billion (CoinMarketCap data).

Solana Price Under Pressure

Following the memecoin crash, Solana (SOL) has suffered significant losses:

- SOL has dropped 58% from its all-time high of $293 in mid-January.

- Currently, SOL trades at $122, down 5% on the day.

With memecoin activity dwindling, Solana’s revenue and ecosystem growth may rely more on DeFi, NFTs, and real-world applications in the coming months.