Mounting geopolitical and economic tensions are weighing heavily on Bitcoin and the broader crypto market.

Key Factors Behind the Decline:

📉 Economic Uncertainty: Tariffs on European goods and escalating trade conflicts are scaring off speculative capital.

🌍 Geopolitical Tensions: From China to the Middle East, global instability is driving investors away from riskier assets like cryptocurrencies.

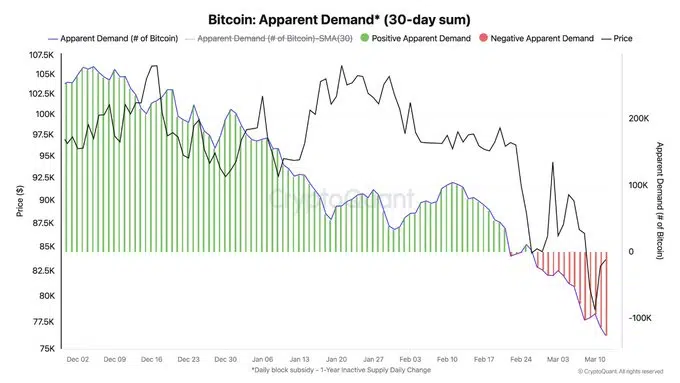

Funds Are Flowing Out, Prices Are Falling

The outflow of capital from crypto ETFs is reaching alarming levels—since February, funds have lost a total of $4.75 billion, with Bitcoin alone seeing $756 million in withdrawals. Altcoins are also suffering, as the total crypto market cap (excluding BTC and ETH) has plunged 27%, from $1.1 trillion to $795 billion.

What’s Next for Bitcoin?

Analyst Matthew Hyland warns that if Bitcoin fails to close the week above $89,000, a correction down to $69,000 could be on the horizon. As for the ultimate bottom? No one dares to predict that with certainty.