Key Takeaways:

-

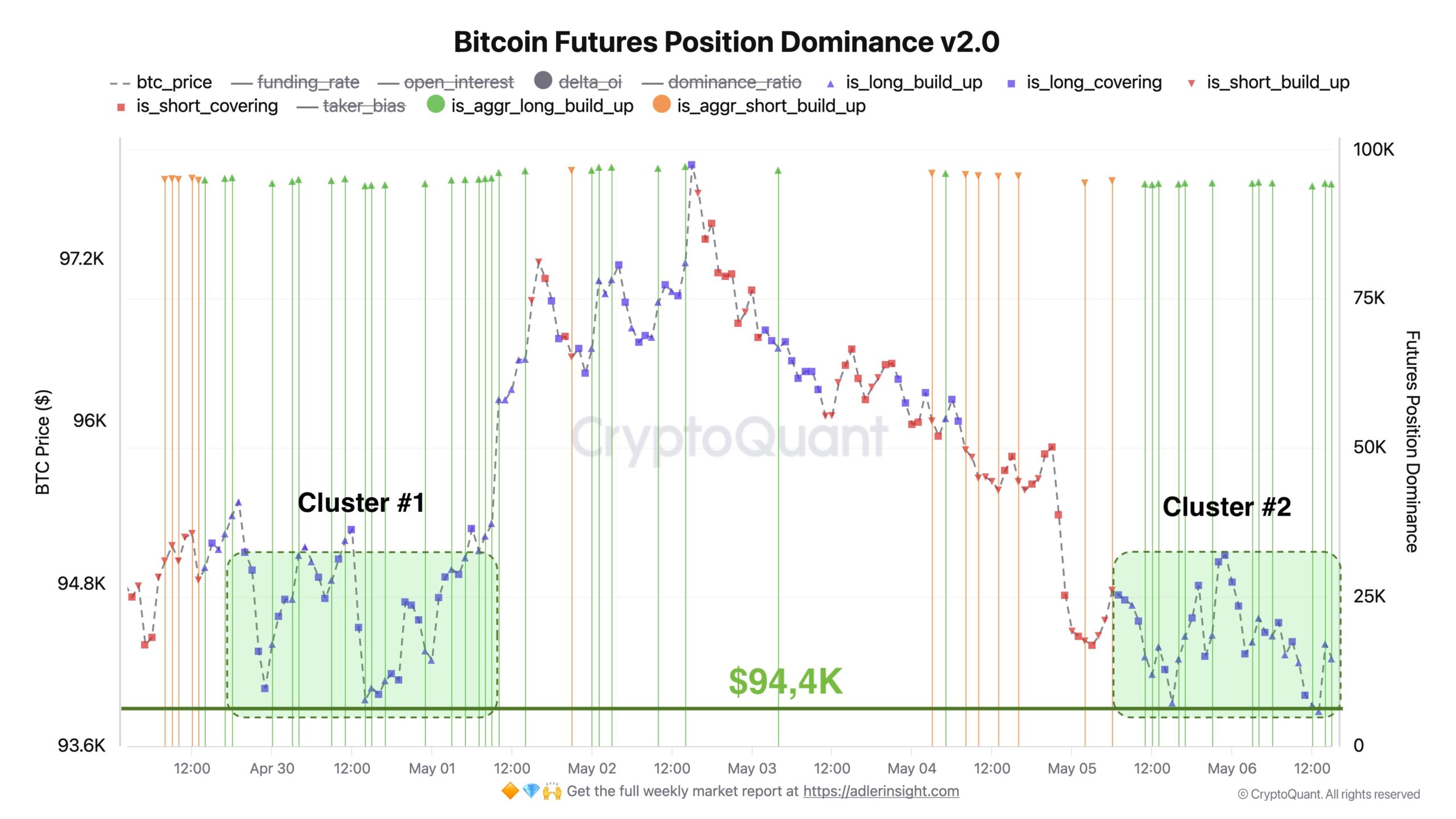

Data shows Bitcoin bulls opening margin long positions from $94,400.

-

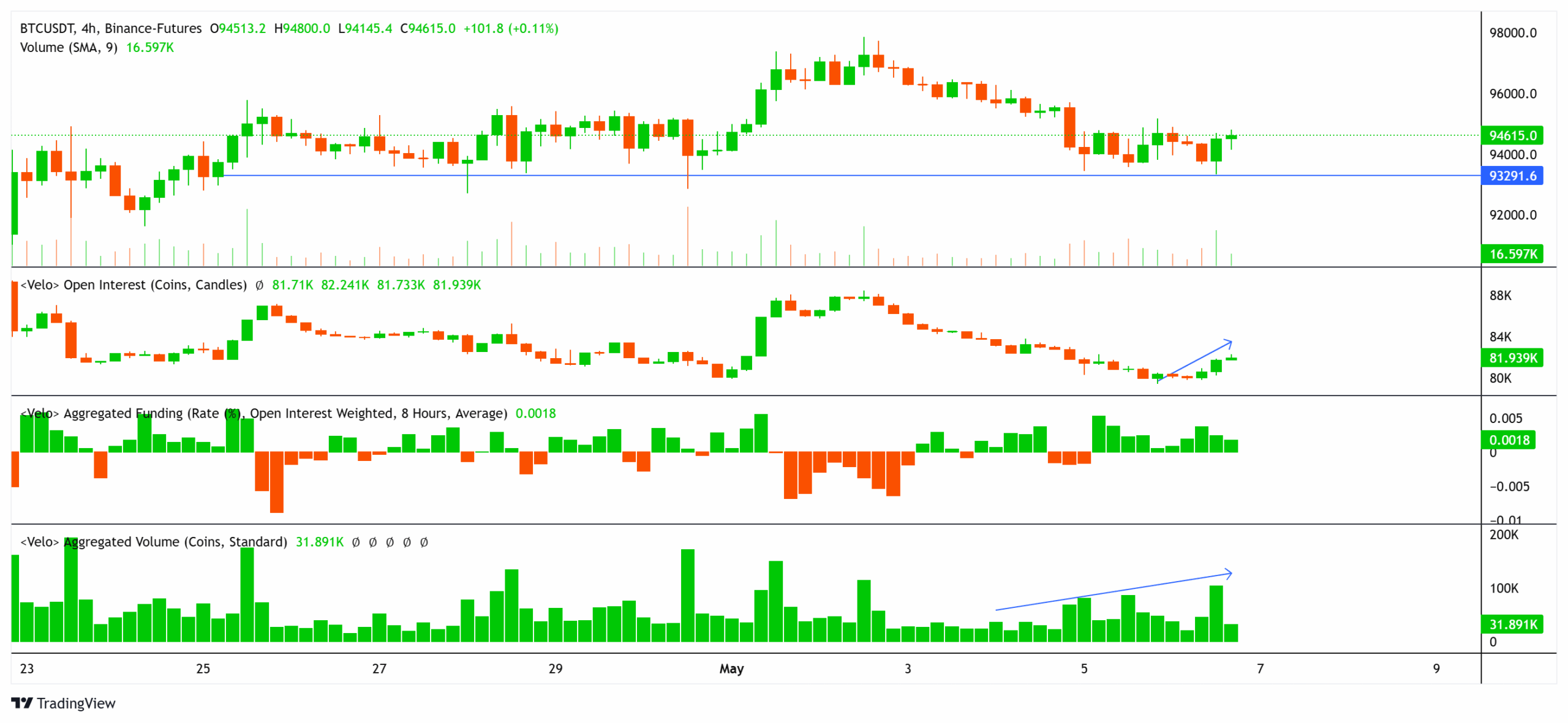

A $189 million increase in Bitcoin futures open interest and a 15% increase in trading volume show sustained buying interest.

-

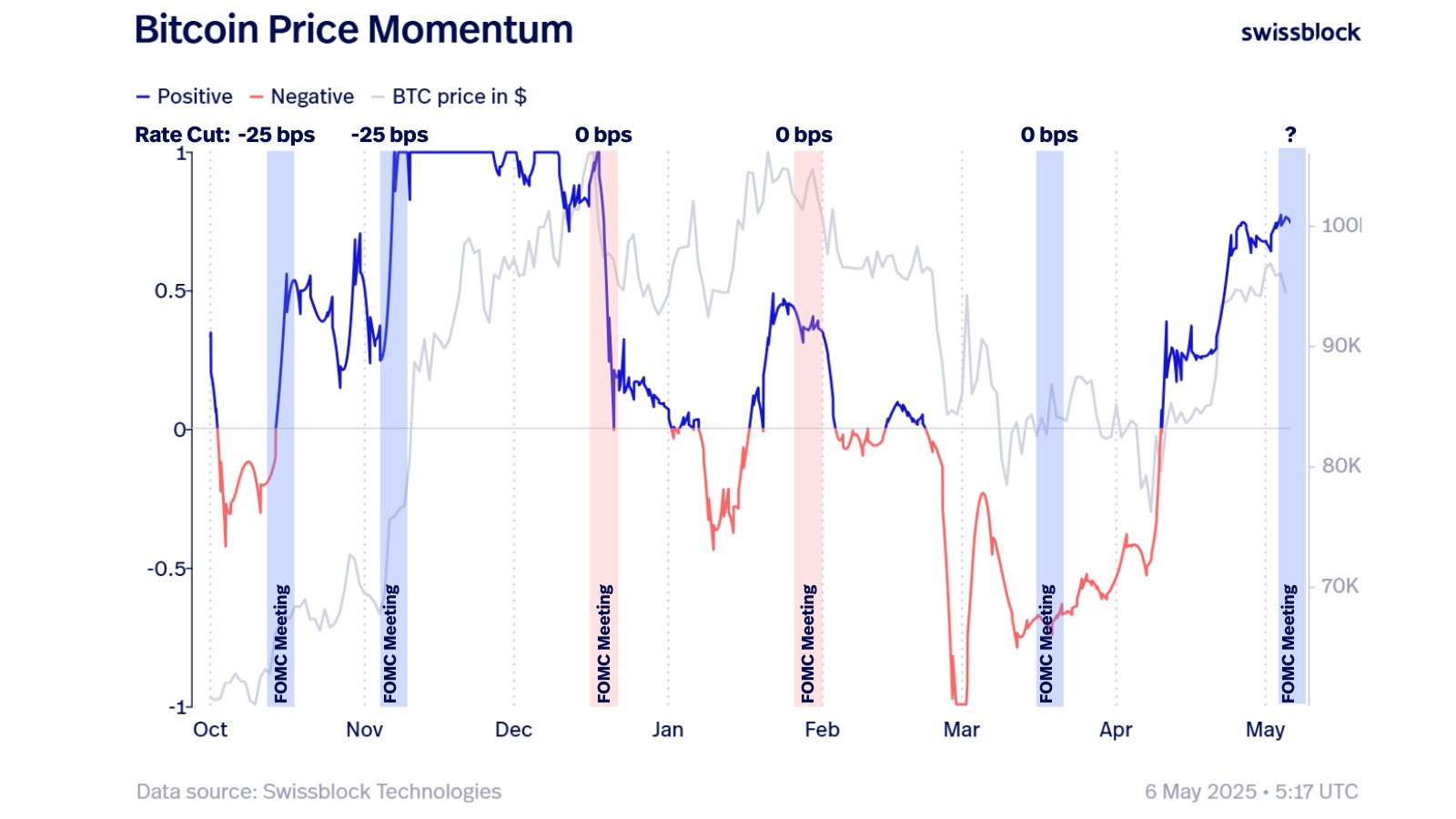

BTC momentum tends to slow before FOMC meetings and then turns volatile afterward. The same could happen following this week’s Federal Reserve statements.

Bitcoin (BTC) bulls are holding strong around the $94,500 level as the market awaits the Federal Open Market Committee (FOMC) meeting on May 7. Bitcoin analyst Axel Adler Jr. noted BTC’s price strength and pointed out a bullish cluster of long positions forming around $94,400 in the futures market. A similar cluster was observed at the end of April, which pushed BTC prices to $97,500.

Similarly, Bitcoin futures open interest (OI) exhibited a swift increase of 2,000 BTC, i.e., roughly $189 million, over the past few hours. A rise in OI and a 15% increase in aggregated volume imply consistent buying pressure despite the price dip.

The aggregated funding rate remains near neutral, indicating balanced sentiment between longs and shorts over the past eight hours. However, funding rates have fluctuated, with brief spikes to 0.018% on May 6, suggesting periodic optimism among leveraged traders.

MN Capital founder Michaël van de Poppe also identified Bitcoin’s bounce and said that BTC could continue to recover in the markets. The analyst said,

“I think we’ll continue the grind on Bitcoin upward, the key factor here is whether Gold starts to correct after FOMC tomorrow, indicating that there’s the start of the business cycle.

Related: Bitcoin sell-off to $93.5K is a brief hiccup — Data still supports new BTC highs in 2025

Bitcoin momentum stalls before FOMC

Swissblock, an investment management firm, revealed that Bitcoin’s momentum typically slowed down before the last five interest rate decisions, followed by a sharp increase in price volatility. In an analysis on X, the firm presented a chart tracking Bitcoin’s 25-day rate of change (ROC) from October 2024 to May 2025.

Bitcoin’s price steadily climbed in the charts whenever the ROC trended up or went positive. It was mainly observed during October-November 2024, and recently in April 2025.

Consequently, when the ROC tapers off, BTC corrects, an outcome observed in January-February 2025. Recent data indicates that the ROC remains on an uptrend in May 2025, which increases the possibility of a price gain for Bitcoin.

Swissblock emphasized that the FOMC meeting is a potential catalyst for Bitcoin’s next move, noting that the rate decision and Federal Reserve Chair Jerome Powell’s tone could spark volatility in financial markets.

Related: Bitcoin price rallied 1,550% the last time the ‘BTC risk-off’ metric fell this low

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.