TL;DR

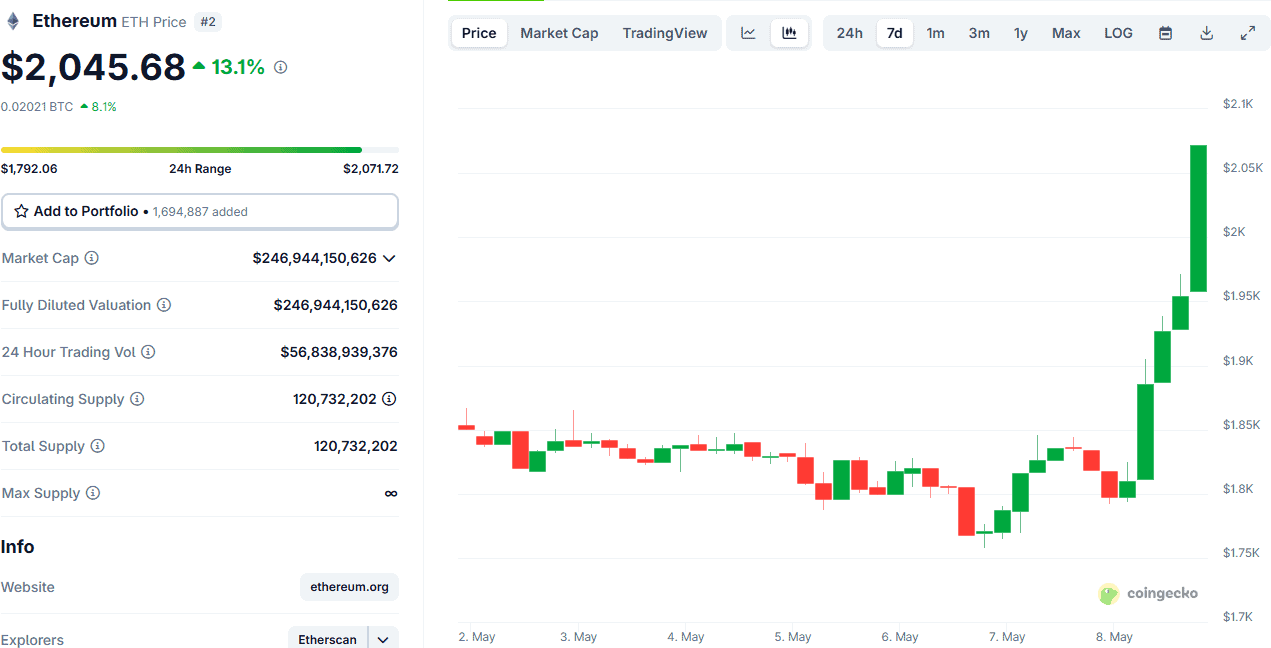

- After a brutal drop below $1,400 in April, Ethereum (ETH) is showing signs of life again, reclaiming key technical levels and surging past $2,000.

- Many analysts are optimistic that the price can go much higher in the near future, with some envisioning a new ATH.

‘The Bull Run Has Begun’

The second-largest cryptocurrency has been among the biggest disappointments of the market during this cycle. It not only failed to chart a new all-time high, but it also trades now lower than it did before the US elections. However, in the past 24 hours, the asset experienced a substantial uptick, rising by over 10% and exploding above $2,000.

Its positive performance could be attributed to the resurgence of the entire cryptocurrency sector, where BTC skyrocketed past $100,000, while the industry’s market capitalization surged above $3.250 trillion. ETH’s rally also followed the implementation of Ethereum’s Pectra upgrade, designed to enhance staking, scaling, and overall network efficiency.

Crypto X is now rammed with analysts predicting a further uptrend for the asset. Captain Faibik argued that ETH is finally reclaiming the daily Exponential Moving Average (EMA) of $1,855. The X user believes that the next critical resistance zone is the $2,100-$2,140 range, and if taken back, “bulls will regain control.”

For their part, Ledger Bull suggested that ETH “is no longer bearish” and “it’s officially waking up.” The analyst assumed that the asset had entered the accumulation flat zone, which, combined with the latest pump, signals the potential start of a bull run.

“Old king ETH is back, and it’s ready to roar,” they added.

Lucky and Merlijn The Trader also outlined optimistic forecasts. The former envisioned a jump towards $4,000 in the following months, while the latter believes ETH could skyrocket to a whopping $12,000 by the start of 2026. He based this theory on the supposed analogy between Ethereum’s price chart in the past three years and the one of bitcoin formed between 2019 and 2021.

Observing Some Signals

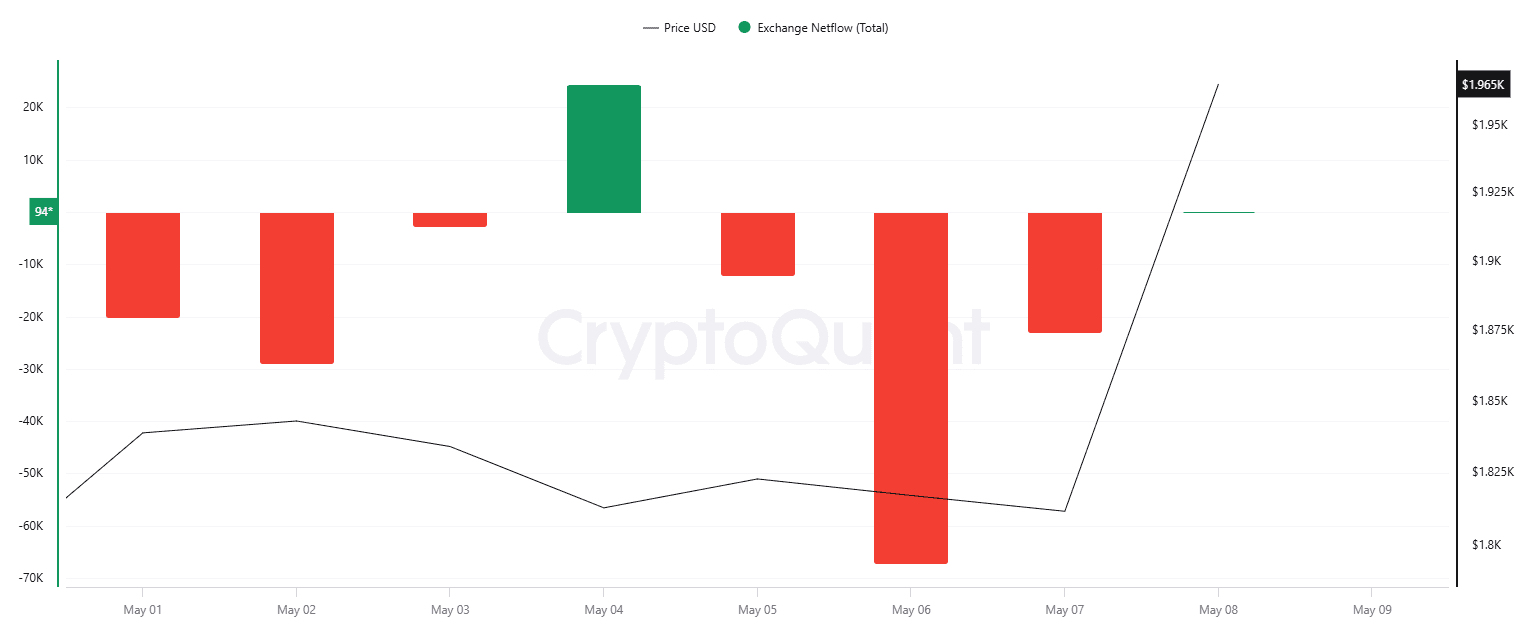

ETH’s overall condition appears quite bullish when taking a closer look at some vital indicators. The asset’s exchange netflow, for example, has been negative in the last week or so, hinting at a shift from centralized platforms toward self-custody methods, which reduces the immediate selling pressure.

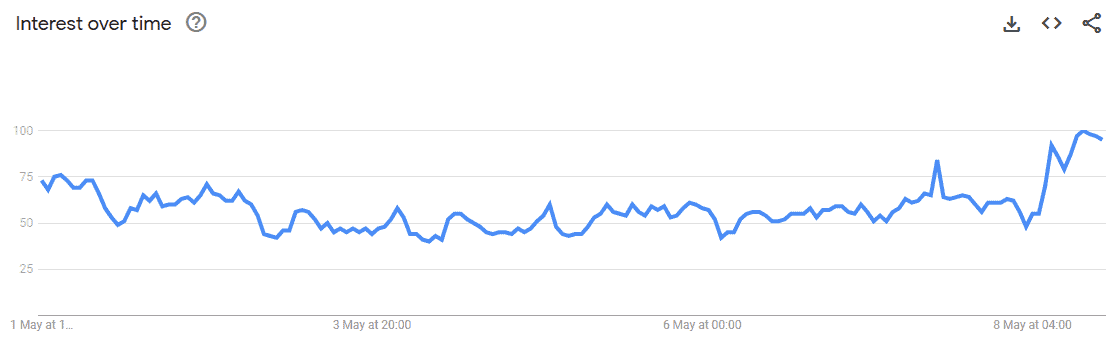

In addition, Google searches involving Ethereum have been on the rise for the past several days. This signals increased interest from investors, especially from retail.

Market participants, though, should keep an eye on the Relative Strength Index (RSI), which recently entered the bearish zone of over 70. Readings above that level indicate that ETH has likely experienced a rapid price increase over a short period, which could be a precursor to an incoming correction.

The post Ethereum (ETH) Is Waking Up: How High Can it Go? (Analysts Weigh in) appeared first on CryptoPotato.