Chainlink (LINK) has observed a sharp price jump as on-chain data shows a large amount of the asset has left centralized exchange wallets.

Chainlink Exchange Outflow Witnessed Spike Ahead Of Price Surge

As explained by analyst Ali Martinez in a new post on X, the LINK Exchange Outflow has registered a large spike in the past day. The “Exchange Outflow” here refers to an on-chain indicator that measures the total amount of Chainlink being withdrawn from the wallets connected to centralized exchanges.

When the value of this metric is high, it means the investors are transferring out a large number of tokens from these platforms. Generally, holders withdraw from exchanges to hold for the long term in the safety of self-custodial wallets, so this kind of trend can be bullish for the asset’s price.

On the other hand, the indicator being low implies demand for taking coins away to self-custody is low. Depending on the trend in the opposite indicator, the Exchange Inflow, such a trend can be either bearish or neutral for the cryptocurrency.

Now, here is a chart that shows the trend in the Chainlink Exchange Outflow over the last couple of weeks:

As displayed in the above graph, the Chainlink Exchange Outflow has witnessed a large spike during the last 24 hours, a sign that a notable amount of the asset has left these platforms.

In total, the investors withdrew more than 3.32 million LINK from exchanges in this outflow spree. At the current exchange rate of the token, this amount converts to a whopping $50.91 million. Given the scale involved here, it’s likely that whale entities were responsible for these outflows.

From the chart, it’s apparent that since the large outflow spike has come, Chainlink has seen a sharp recovery rally. This could potentially indicate that the withdrawals corresponded to fresh buying from whales who were anticipating the run.

Considering this pattern, the Exchange Outflow could now be to keep an eye on, as more surges in it could perhaps foreshadow a continuation to this 13% rally for LINK.

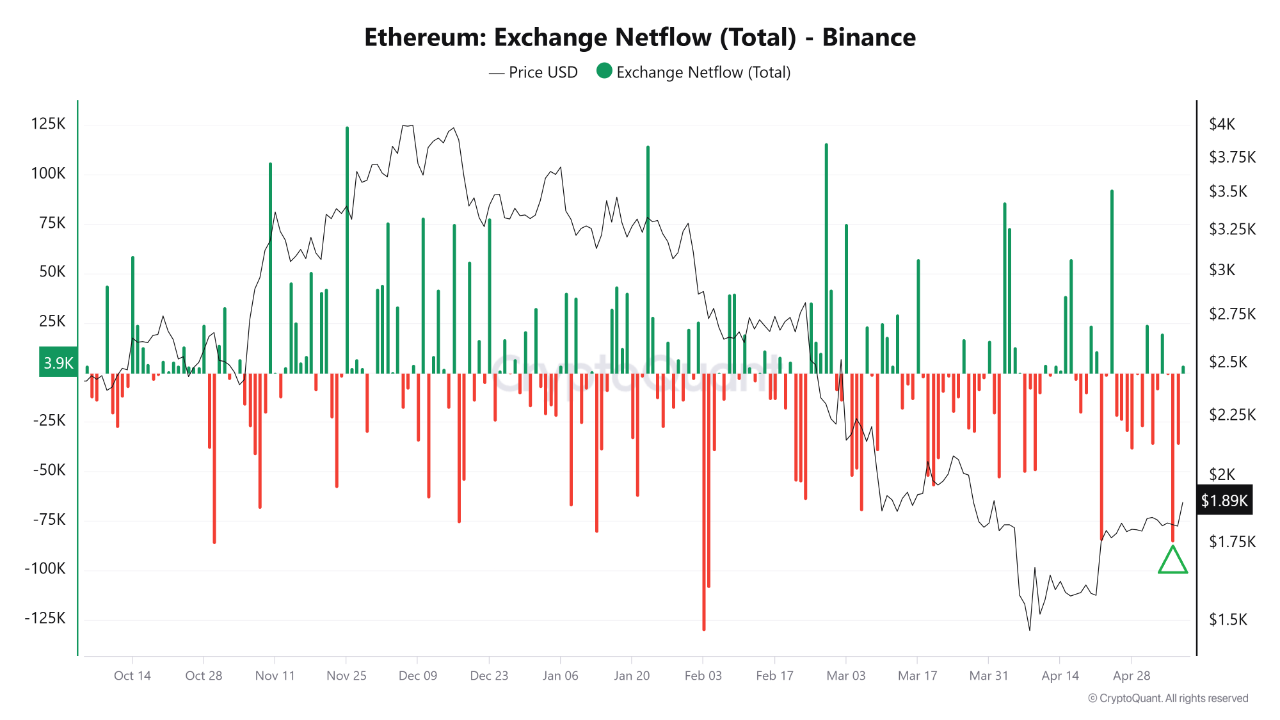

In some other news, Ethereum, the second largest coin in the digital asset sector, has also seen significant outflows recently, as an analyst has pointed out in a CryptoQuant Quicktake post.

As is visible in the graph, Ethereum saw a large negative spike on the Binance Exchange Netflow ahead of its recovery rally. The Exchange Netflow measures the net difference between inflows and outflows, so a negative value like this implies net withdrawals have occurred on the platform.

LINK Price

At the time of writing, Chainlink is floating around $15.3, up almost 14% in the last 24 hours.