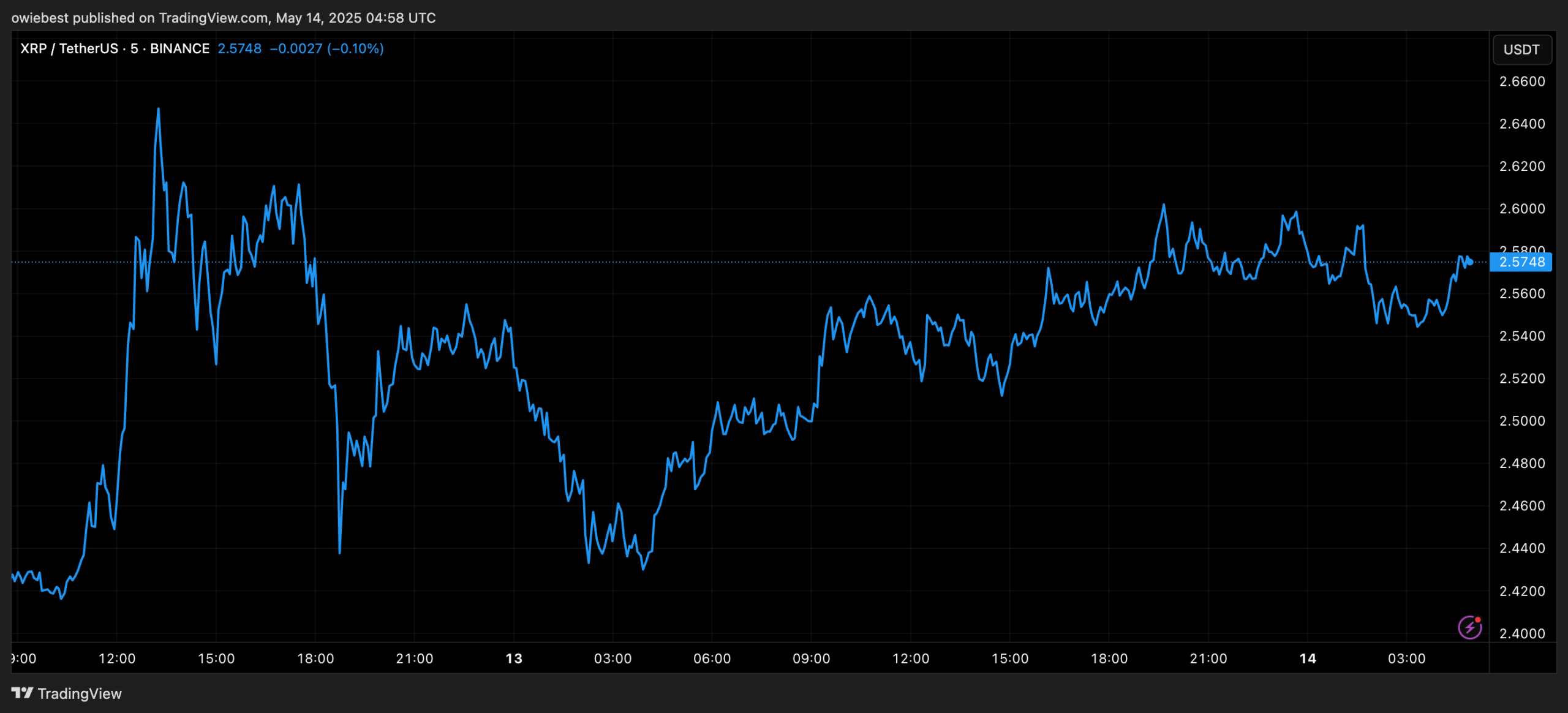

XRP continues to hold support even after the crypto market retracement, but this push by the bulls could end up being temporary. A crypto analyst has suggested that the XRP price is on the cusp of a major crash, which could send it to levels not seen since 2024. This comes with the formation of an exit liquidity pattern that has previously marked the top for the altcoin in the past.

Exit Liquidity Phase Spells Bad News For XRP

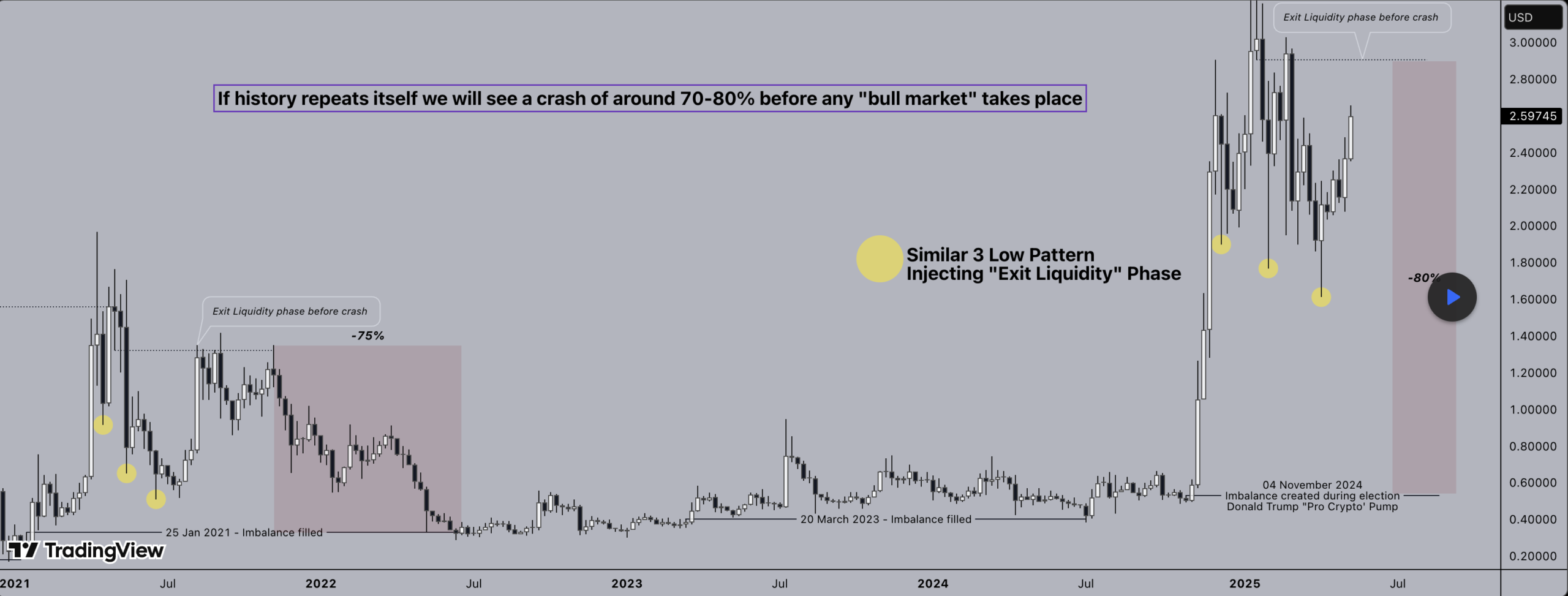

In the past, when the XRP price has surged, the top has usually been marked by an exit liquidity phase. The last time this was seen was back in 2021, marking the end of the XRP price rally and resulting in a major crash for the crypto asset. Now, this pattern is forming again, according to crypto analyst Oky_Bren on TradingView.

In the analysis, the crypto analyst explains that this exit liquidity phase is usually marked by a number of factors, the first of which is the formation of three similar lows. This is shown in the chart using the yellow dots, as it appeared back in 2021. The next stage is then a large spike in price to produce liquidity for institutions to exit, and then a dump that leaves late buyers stuck.

This time around, the analyst points out that the first low was made back in December 2024, with subsequent similar lows then made in February and April 2025. Given this, they explain that the exit liquidity phase pattern is forming again.

There has also been a spike in the XRP price, but it seems that there is still a long way to go before this part of the pattern is complete. The crypto analyst puts the top of the rally somewhere around $2.9 before profit-taking begins and the crash is in view.

If this pattern plays out the way it has in the past, then a major crash in the XRP price is expected as previous formations have led to 70-80% declines in price. In this case, a 70% crash would see the XRP price falling back toward $1, and even possibly below $1.

Generally, the analyst has said that the market pump triggered by Donald Trump’s pro-crypto stance has created an imbalance in the market. This has contributed to the formation of the 3-low structure. “We’ve seen this repeated pattern across prior market cycles — and 2025 is shaping up no differently,” the analyst wrote.