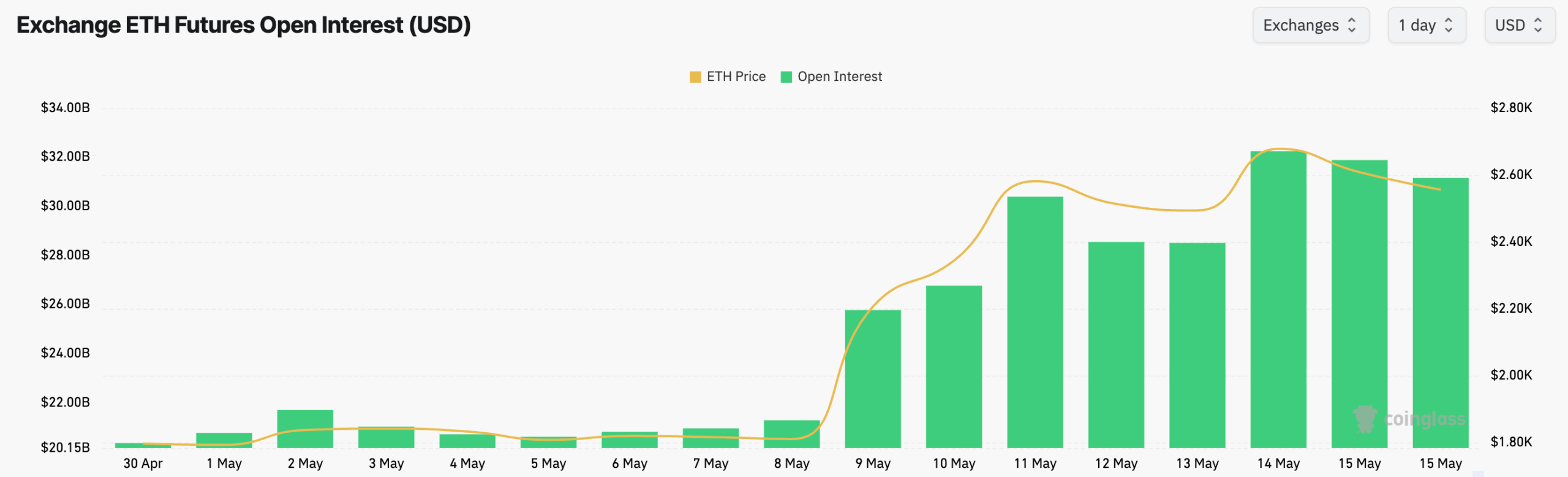

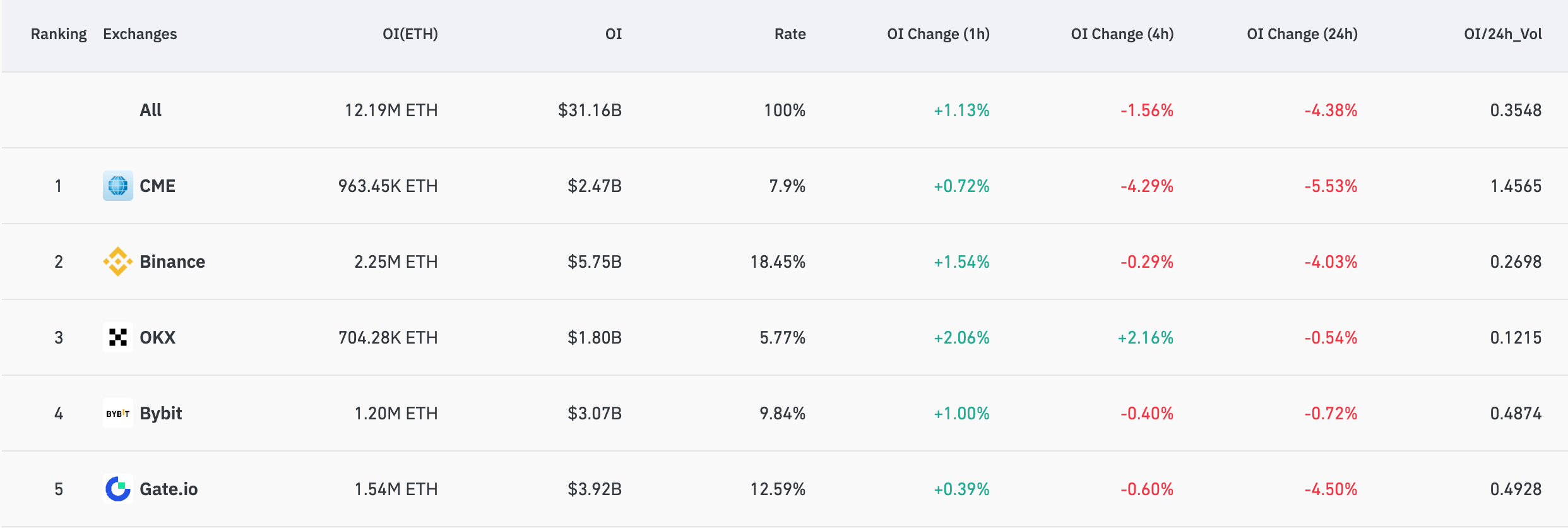

Ethereum futures open interest (OI) increased by 50% this month, climbing from $20.77 billion on May 1 to $31.16 billion by May 15. This sharp rise in speculative positioning followed Ethereum’s decisive breakout above the key psychological threshold of $2,000 on May 8.

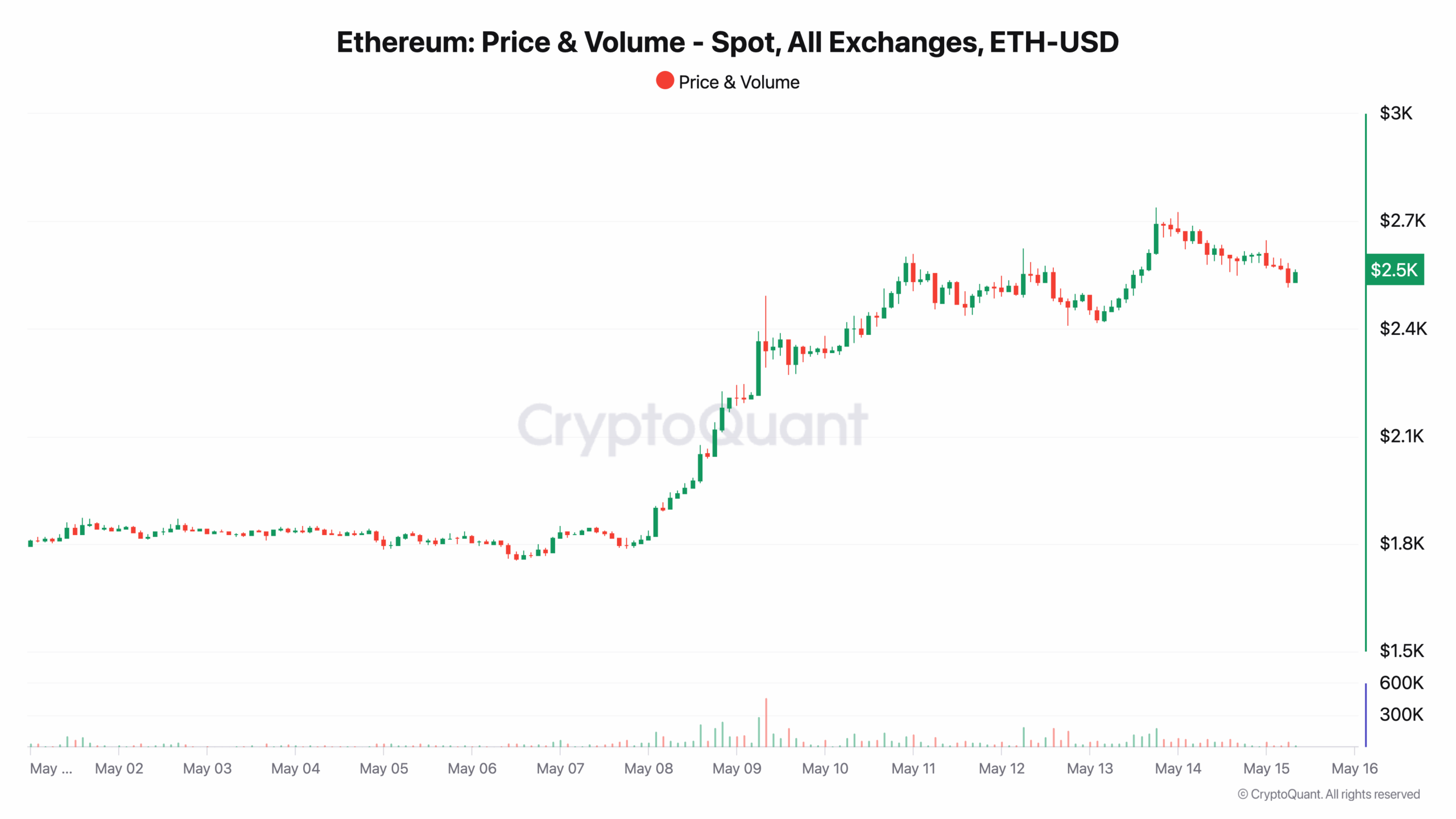

Before this breakout, ETH spent over two months trapped below $2,000, struggling to regain upward momentum since the broader market correction in March.

The timing between price action and futures activity suggests that the increase in open interest was reactive rather than anticipatory. Traders appeared to ramp up their exposure once Ethereum confirmed strength above $2,000, betting on a sustained bullish momentum.

Spot prices rose to $2,700 by May 13, reinforcing bullish sentiment across spot exchanges. However, the futures market absorbed the bulk of the enthusiasm, with OI growth outpacing spot volume increases.

Binance and Bybit, both hubs for retail traders, recorded strong positioning inflows, while CME, a proxy for institutional activity, showed a more muted reaction and even posted a 5% decline in OI over the past 24 hours.

The expansion of futures exposure, especially in a context where spot buying remains relatively measured, introduces a layer of fragility. A rapid buildup of open interest without continuous spot demand leaves the market vulnerable to deleveraging events.

For now, Ethereum’s ability to defend the $2,000 level will be critical in determining whether the aggressive futures positioning leads to a continuation higher or sets the stage for abrupt liquidations.

The post Ethereum futures open interest rose 50% in May as ETH broke $2,000 appeared first on CryptoSlate.