Bitcoin is trading above the key psychological level of $100,000, but the bullish momentum that drove prices higher in recent weeks has cooled as BTC fails to reclaim resistance near $105,000. After a sharp rally that saw Bitcoin surge more than 40% from its April 9th low, price action is now consolidating and testing demand. While bulls remain in control above the $100K mark, growing signs of uncertainty have led some analysts to warn of a potential breakdown if $100K fails to hold.

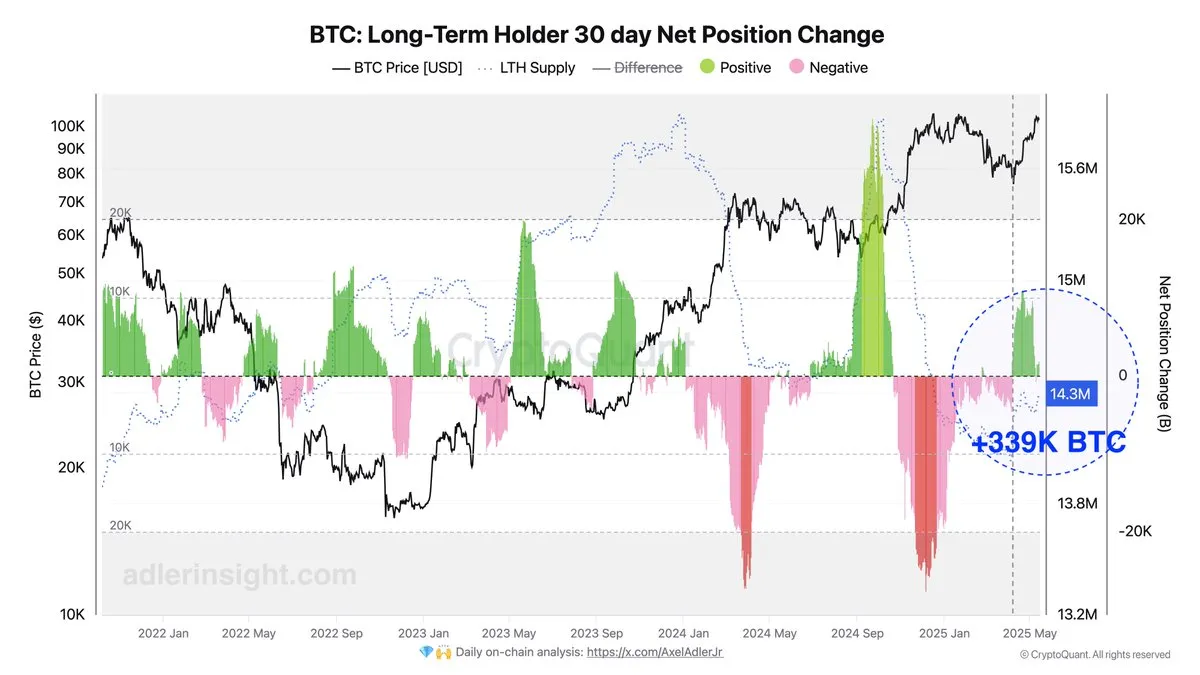

Despite these short-term concerns, long-term fundamentals remain strong. Data from CryptoQuant reveals that since April 4, Long-Term Holders (LTH) have added 339,000 BTC to their holdings. The consistent accumulation by long-term investors adds weight to the bullish thesis, showing continued conviction in Bitcoin’s long-term value, even as short-term traders express hesitation.

The coming days will be critical, as Bitcoin must either confirm $100K as solid support or risk a deeper pullback. All eyes are on whether demand will hold, and whether LTH accumulation can offset rising market fear.

Long-Term Holders Add Fuel To Bitcoin Bullish Outlook

Bitcoin is currently in a pivotal phase that could define the trajectory of the market for the coming months. After rallying over 40% from its April 9th low, BTC has spent the last few days consolidating below the $105K resistance. This consolidation has sparked a mix of expectations—some traders anticipate a breakout into a new all-time high, while others believe the market could be setting up for an extended range.

Despite short-term volatility, the broader trend remains clearly bullish. Bitcoin has maintained a steady uptrend for over five weeks, climbing through multiple resistance levels and attracting renewed investor attention.

One of the most significant signals of confidence comes from the behavior of long-term holders. According to data shared by top analyst Axel Adler, since April 4, long-term holders (LTH) have added a total of 339,000 BTC to their wallets. This brings the total LTH supply to 14,370,338 BTC—a record figure that underscores deep conviction in Bitcoin’s future value.

This wave of accumulation is a powerful bullish signal. Historically, periods of heavy LTH buying have preceded major rallies. If BTC can hold current demand zones and reclaim resistance, the market could enter a new phase of expansion. However, if resistance holds and momentum weakens, the market could remain trapped in a broader consolidation. For now, the pressure is on bulls to confirm strength, and LTH accumulation shows they’re not backing down.

BTC Holds Above Support, But Breakout Remains Elusive

The 4-hour chart shows Bitcoin continuing to consolidate just above the $103,600 support level after failing to break cleanly above the $105,000 zone. Price action remains tightly ranged between $103,600 and $104,800, with multiple failed attempts at pushing higher, suggesting the presence of heavy sell-side liquidity in that region.

Despite this, Bitcoin’s structure remains bullish. The 200-period EMA and SMA on this timeframe are both trending upward and significantly below the current price, providing a strong foundation for continued support. Volume has slightly decreased during consolidation, which is typical in a pause phase before a potential breakout or breakdown.

If BTC holds above the $103,600 support, bulls may soon attempt another breakout, especially if volume picks up and macro conditions remain favorable. A confirmed move above $105,000 would likely trigger a surge toward the next key psychological target near $110,000. On the downside, a loss of $103,600 opens the door for a deeper pullback toward $100,000—an area of strong psychological and structural demand.

Featured image from Dall-E, chart from TradingView