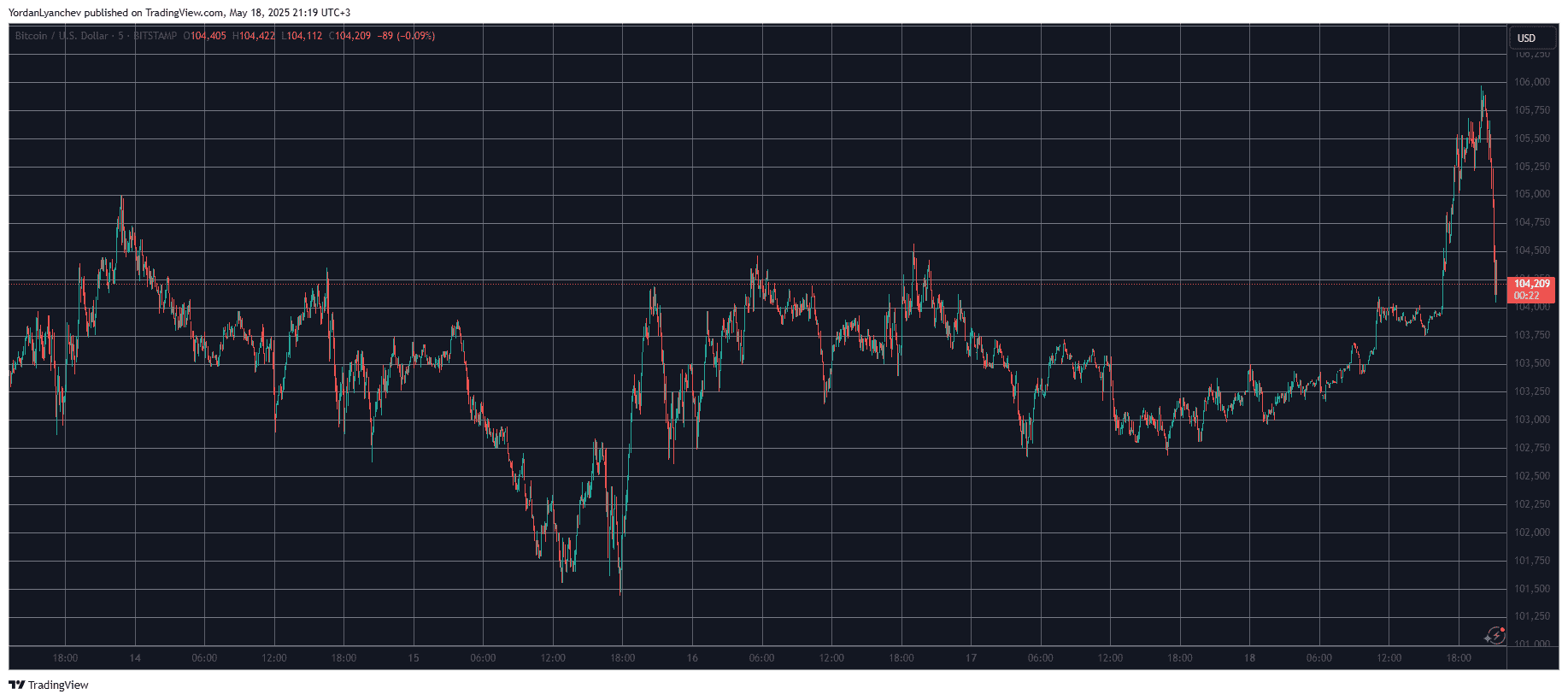

Following a relatively boring Friday and Saturday, bitcoin’s price went on the offensive on Sunday evening and shot up to its highest level since the end of January at $106,000.

However, the bears were quick to step up at this point, and the asset plunged by two grand in an instant.

Recall our Market Watch from this morning, which informed that BTC had returned to familiar ground at around $104,000 after a brief dip below $103,000, which allowed an anonymous whale to open a massive long position worth nearly $400 million on Hyperliquid.

Live data from CoinGlass indicates that the large market participant has closed a portion of his position, which is now worth a more modest $337 million.

This transpired in the past few hours, during which BTC’s price quickly pumped from $104,000 to a multi-month peak at $106,000, where it faced a violent rejection and was pushed south to its starting point within minutes.

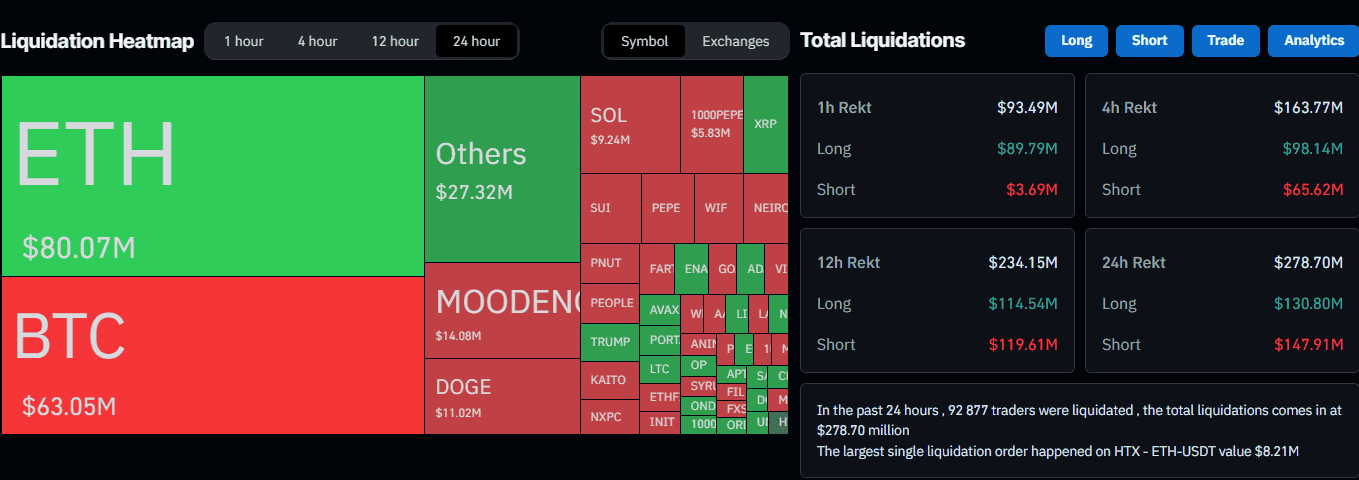

The total value of wrecked positions has risen to almost $280 million on a daily scale, with the majority of that taking place in the past 12 hours.

BTC short positions actually have the second-biggest share of the pie, as ETH longs dominate with over $80 million.

More than 90,00 traders have been wrecked in the past day, while the single-largest liquidated position took place on HTX, involved the ETH/USDT pair, and was worth $8.21 million, says CoinGlass.

The post Liquidations on the Rise as Bitcoin (BTC) Pumps and Dumps on Sunday appeared first on CryptoPotato.