The unwind followed Bitcoin’s surge to a fresh all-time high above $111,000 on 22 May before prices slipped toward $107,000 and then back to $110,000 during London trading on Friday.

The reversal coincided with a risk-off turn after U.S. President Donald Trump threatened a 50% tariff on EU imports, rattled equities, and spilled into crypto.

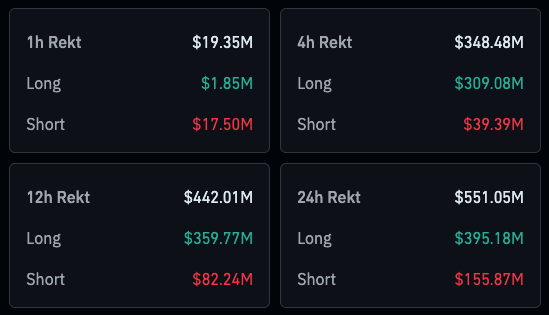

Exchange data shows Bybit bore the brunt, recording $197.1 million in liquidations (79% long), followed by Binance with $161.1 million and OKX with $81.1 million. Ethereum futures added another $140.2 million in margin calls.

Outside of macro events, elevated funding rates and crowded bullish positioning in the run-up to the record print impacted the market.

Traders are now watching whether collective funding rates flip negative, a sign of capitulation, and whether price can hold above the $105,000-$107,000 support band carved out earlier in May. Macro drivers loom, with U.S. PCE inflation data due on 30 May and further updates on the tariff dispute expected next week.

The post Over $550 million liquidated as Bitcoin whipsaws back to $110k appeared first on CryptoSlate.