With bearish pressure growing in the market, Bitcoin seems to have entered a period of consolidation after rallying for several weeks. Over the past few days, the flagship asset has been hovering between the $103,000 level and the $107,000 threshold. During this recent upward trend, key market players have maintained a bullish sentiment toward BTC.

Whale Investors Stock Up On Bitcoin

Bitcoin has not fully lost its upward momentum, considering its position beyond the $100,000 price mark. As the flagship asset slowly regains momentum, on-chain data reveals that the number of BTC held by large holders, known as “whales,” has been steadily rising.

These deep-pocketed investors are quietly expanding their holdings following a shift toward bullish movements that led to a new all-time high for BTC. The increase in whale supply shared by Darkfost, a market expert and verified author, reflects a rising interest and confidence in BTC’s long-term prospects among high-net-worth investors.

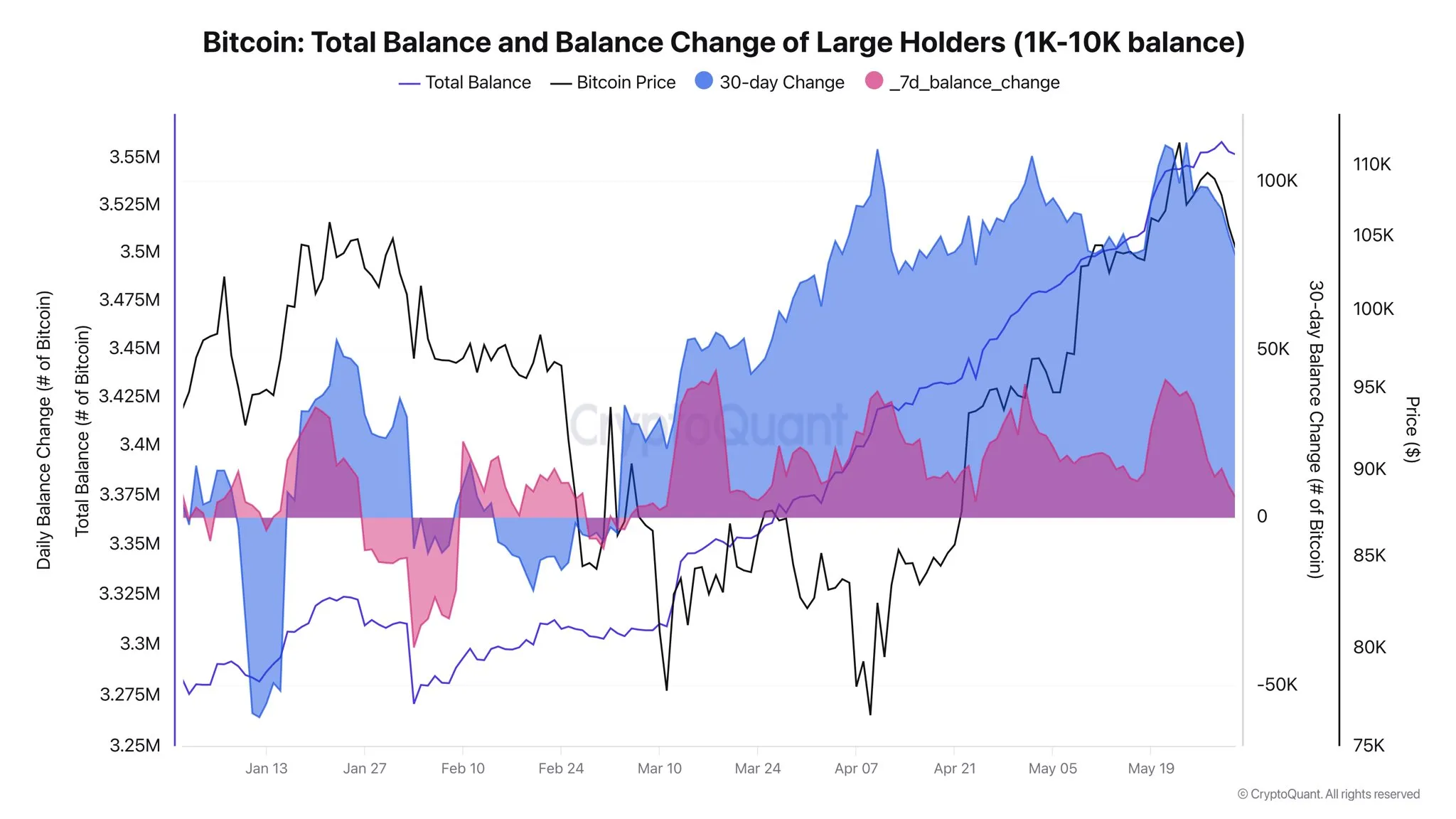

In the report, Darkfost highlighted that the supply held by large investors, particularly wallet addresses holding between 1,000 and 10,000 BTC, has grown constantly since March 11. Interestingly, BTC’s price fell below the $78,000 level on this day before transitioning toward an upward trend, indicating an accumulation-driven rally.

As of Monday morning, the amount of supply held by these big wallet addresses moved from 3.3 million BTC to a total of 3.5 million BTC, representing a more than 5% increase. Such a notable growth in accumulation could add an extra layer to Bitcoin’s uptrend and possibly set the stage for a fresh bullish move that can cause prices to surge to new highs.

According to the on-chain expert, the cohorts have added over 78,000 BTC to their supply over the past 30 days. Meanwhile, 6,000 BTC have been amassed in the last 7 days, a sign of sustained conviction in the digital gold.

Although accumulation is slowing down in the very short term, Darkfost claims it remains relatively strong in spite of the new all-time high reached on May 23. “For now, confidence still reigns among the whales,” the expert added.

BTC Whales Are No Longer Shorting The Asset

Another instance of bullish conviction among large Bitcoin investors is their recent waning interest in opening short positions as prices hover near key resistance levels. On-chain expert and founder of Alphractal, Joao Wedson, stated that whales have stopped shorting BTC after evaluating the Bitcoin Whale Position Sentiment metric.

Considering the positive development, Wedson is confident that BTC might see some relief from here and experience a week of positive price movements. With upside strength building as BTC’s price revisited the $106,000 mark earlier today, the author has stressed the importance of monitoring this trend to stay 10 steps ahead of the crowd.