World Liberty Financial, a DeFi venture part-owned by a trust of US President Donald Trump, has kicked off a new airdrop campaign targeting early backers.

On June 4, the blockchain analytics platform Lookonchain confirmed that the project began distributing $47 worth of its USD1 stablecoin to wallets that participated in the WLFI token sale.

The airdrop, approved by community vote weeks earlier, aims to reward initial supporters, increase liquidity for USD1, and stress-test the project’s token distribution mechanism under live market conditions.

Meanwhile, market observers believe the firm selected the $47 figure to honor Trump’s designation as the 47th President of the United States. This symbolic gesture adds a political and cultural layer to what would otherwise be a standard reward mechanism.

USD1

Launched in April 2025, USD1 is WLFI’s core stablecoin. It is pegged to the US dollar and backed by reserves such as Treasuries and cash equivalents.

Since its debut, USD1 has gained traction on centralized and decentralized platforms, with listings on exchanges including Binance and Bitget.

In addition, the WLFI team has been pushing for memecoin trading pairs involving USD1 to widen exposure and drive user engagement on decentralized platforms. The team announced on X:

“Up to $1 million in rewards, a 4-week trading campaign, and exclusive support for the top trading pools & meme projects.”

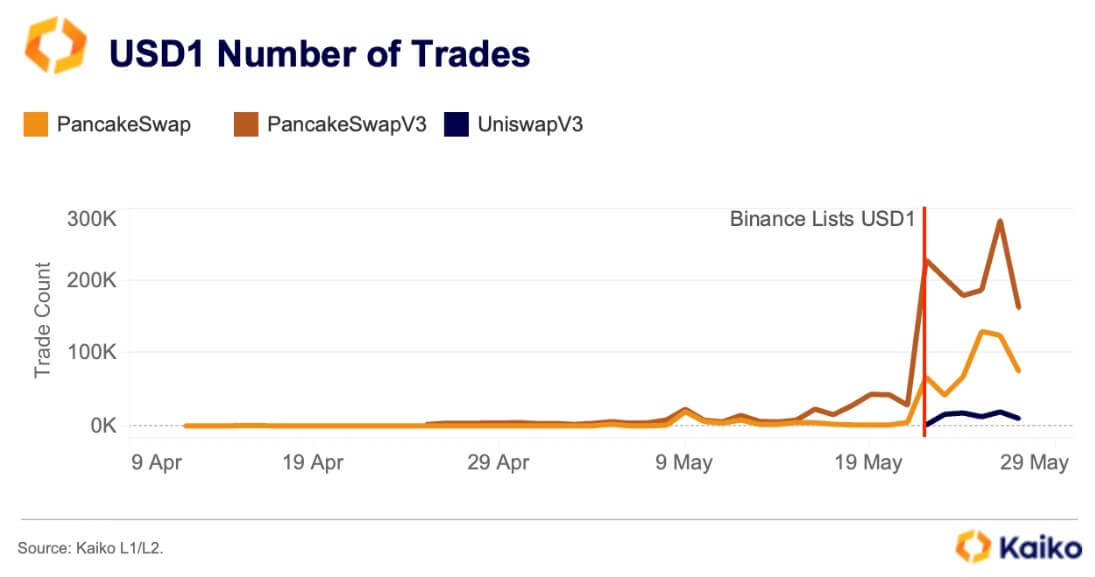

Notably, the digital asset’s trading is mainly dominated by on-chain activity.

For context, analysts at blockchain analysis platform Kaiko reported that PancakeSwap’s USD1 pairs recorded an average daily trading volume of $14 million in the last 30 days, significantly outpacing Binance’s $8 million.

In addition, PancakeSwap V3 trades surged after the Binance listing, jumping from 28,000 on May 21 to over 283,000 by May 26.

Despite this momentum, USD1 continues to face criticism over centralization. Kaiko pointed out that three wallets control most of the circulating supply, sparking concerns about liquidity and governance risks.

They also noted that the stablecoin’s slower adoption than rivals is partly due to its lack of institutional backers and minimal promotional incentives.

Moreover, the project hasn’t escaped political scrutiny.

Senator Elizabeth Warren recently criticized the initiative, citing its alleged ties to a controversial deal with the United Arab Emirates. She argued that such connections undermine legislative efforts and urged Congress to delay a crypto-related bill she believes could enable further misconduct.

The post World Liberty Financial airdrops $47 USD1 stablecoin in symbolic ‘stimulus’ nod to Donald Trump appeared first on CryptoSlate.