In the 24 hours between June 11 and 12, the crypto market saw $336.84 in liquidations, with over 114,000 traders rekt as leveraged positions were flushed out across most exchanges.

Nearly 74% of total liquidations came from longs following a sharp intraday correction, most likely driven by a retracement in ETH, which alone accounted for over $113 in forced exits.

Ethereum’s dominance in the liquidation charts stands out, nearly doubling Bitcoin’s $58.54 million. This pattern often emerges when ETH outperforms during rallies and then sharply corrects, catching overexposed long traders off guard.

The ETH-led cascade extended across other majors, including $13 million in Solana and $10.75 million in Dogecoin liquidations. Data from CoinGlass showed that mid-caps such as XRP, SUI, and PEPE registered visible but less concentrated losses.

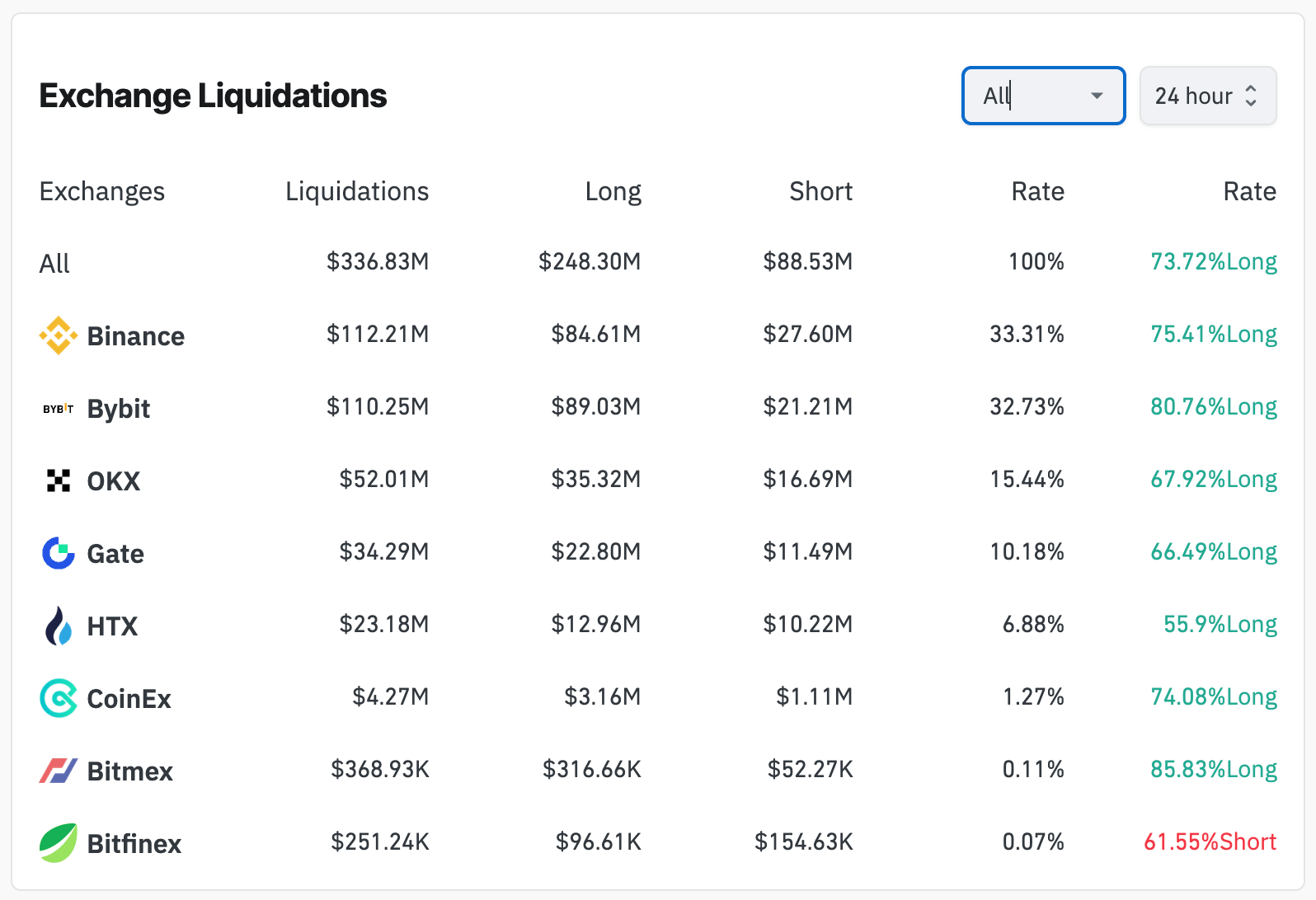

Exchanges followed their usual hierarchy, with Binance and Bybit jointly accounting for two-thirds of all forced closures, $112.21 million and $110.25 million, respectively. OKX and Gate trailed with $52 million and $34 million.

Long exposure dominated most venues, particularly on BitMEX and Bybit, where over 80% of liquidations were longs. Bitfinex was the only exception, skewing toward short liquidations, likely reflecting a different trader profile, typically lower leverage, and discretionary directional bets.

The largest single liquidation, a $2.15 million BTCUSD-PERP order on Binance, suggests one-sided positioning ahead of a price swing.

This continues a broader pattern seen in recent weeks where traders loaded into long positions during periods of low volatility, leaving them vulnerable to sudden downside moves.

The post Ethereum leads $336M liquidation wave with heavy long losses appeared first on CryptoSlate.