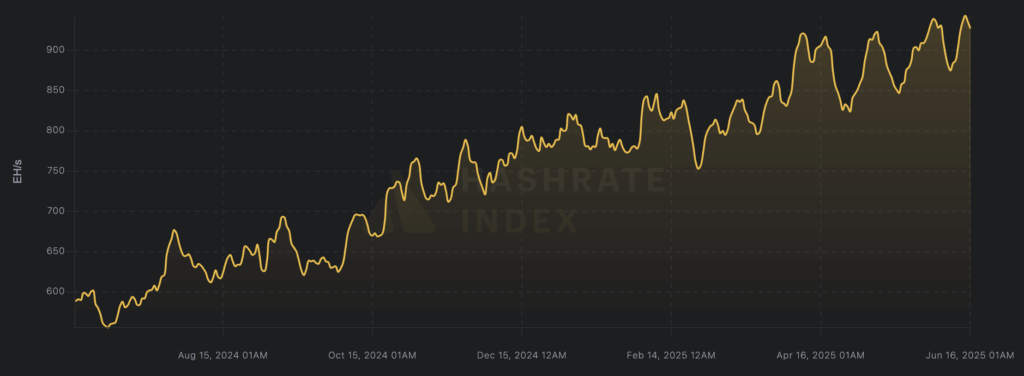

Amid the minor 0.45% drop in Bitcoin mining difficulty on June 14, the network’s total hashrate surged to a fresh record of 943 EH/s.

This juxtaposition emphasizes a resilient and increasingly concentrated mining sector in which top players are accelerating hardware upgrades to maintain margins in a post-halving environment.

The difficulty dip offered a fleeting window of relief, but forward-looking models already point to an upward retarget, signaling that the pressure on miners is far from over.

Key insight

The slight difficulty drop isn’t a turning point; the surging hashrate outpacing block-time targets is a designed side-effect.

Rather than signaling miner capitulation or network weakness, this adjustment reflects how aggressively miners are scaling, even amid thinning rewards.

The net effect is that smaller operators continue to be squeezed out, while the biggest farms consolidate their lead via newer rigs and cheap power. Forty-eight hours after the adjustment, the hashrate has retreated slightly to 926 EH/s, likely as smaller miners struggle to compete.

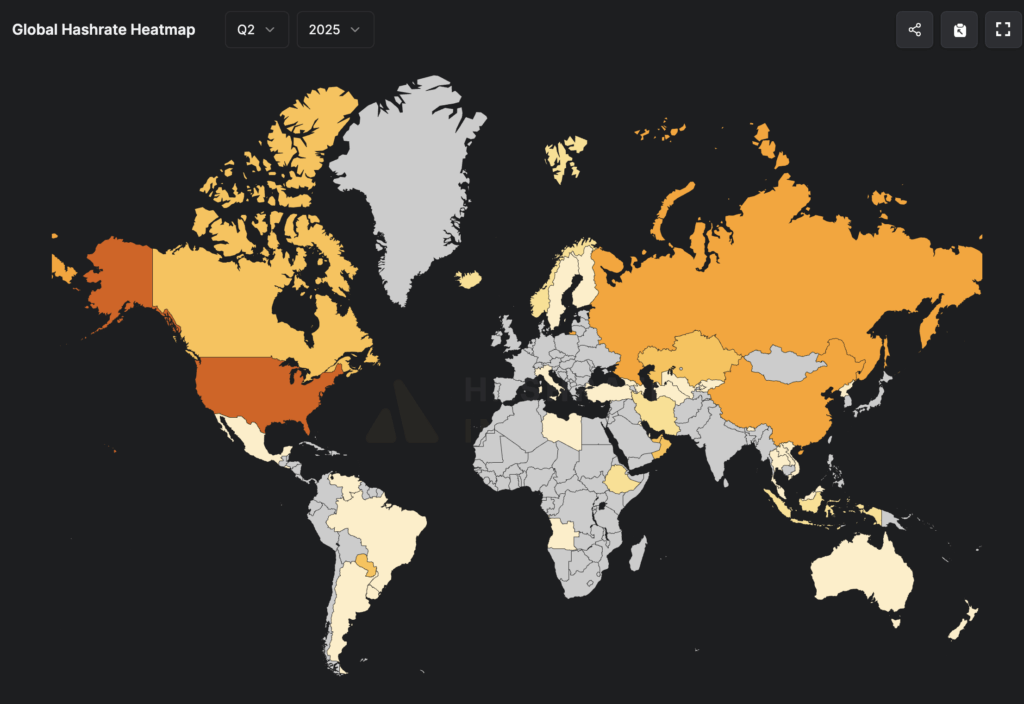

Across the globe, America holds a significant hashrate lead at 36% of the network, followed by Russia and China with 15% and 13.7%, respectively.

Data driving this

| Metric | Value | Signal |

|---|---|---|

| Difficulty (14 Jun) | 126.41 T | -0.45% vs. prior – first dip in 5 weeks |

| Hashrate (16 Jun) | 926 EH/s | All-time high, rose post-adjustment |

| Hashprice | $52.9 / PH/s-day | Down ~5% MoM, showing margin compression |

| Avg. block time | 9m 58s | Slightly under target – triggered the retarget |

| Next difficulty est. | +0.17% | Early projection for 28 Jun upward shift |

The post Bitcoin hashrate hits new high of 943 EH/s as difficulty adjusted down 0.45% appeared first on CryptoSlate.