Bitcoin continues to show resilience despite heightened volatility caused by the ongoing conflict between Israel and Iran. The geopolitical tension has led to sharp moves across global markets, but BTC has held firm above the $105,000 level. This price action suggests that the market is in a waiting phase—investors are cautious but not selling aggressively, possibly awaiting more clarity before committing to the next major move.

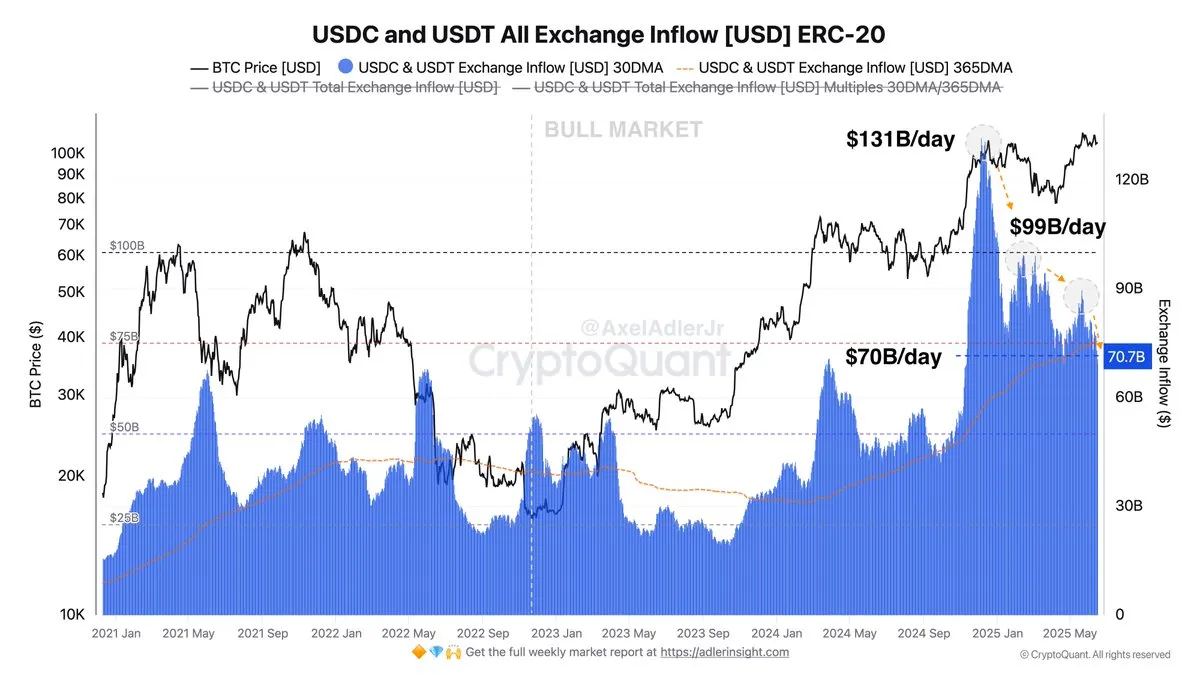

Top analyst Axel Adler shared important liquidity data that helps explain the current market mood. In December 2024, when BTC traded between $98K and $100K, the average daily inflows of USDT and USDC into centralized exchanges (CEXs) hit a record high of $131 billion. This influx of stablecoins signaled intense buying pressure and bullish momentum at the time.

However, by June 2025, daily inflows have cooled down significantly to around $70 billion—$5 billion below the 365-day average and a staggering $61 billion below the December peak. This drop indicates a natural slowdown in exchange-directed liquidity, which typically fuels price rallies. Yet, with Bitcoin still holding above $105K, it appears market participants remain confident, and the current phase may simply reflect consolidation before the next breakout.

Bitcoin Consolidates Amid Uncertainty And Slower Liquidity Flows

Bitcoin has entered a consolidation phase following an expansive rally that lifted prices from the $74,000 level to an all-time high near $112,000. This pullback comes amid a complex macroeconomic environment marked by rising US Treasury yields, inflation fears, and escalating geopolitical tensions, particularly the unfolding conflict between Israel and Iran. These overlapping risks have weighed heavily on investor sentiment, making the coming weeks pivotal in determining Bitcoin’s next major move.

Despite the volatility, many analysts remain optimistic, expecting Bitcoin to reclaim its previous highs and enter price discovery. Market participants continue to monitor on-chain and liquidity metrics to gauge sentiment and conviction.

One key insight comes from Axel Adler, who shared that back in December 2024—when BTC traded in the $98K–$100K range—daily inflows of USDT and USDC into centralized exchanges peaked at $131 billion. As of June 2025, those flows have dropped to $70 billion per day, which is $5 billion below the 365-day average and $61 billion under the December high.

This notable decline in liquidity reflects a cooling of speculative momentum. However, BTC holding above $100K suggests that long-term holders remain committed, and widespread selling has not occurred. This signals that the market may be undergoing a healthy period of base-building before another breakout.

Price Action Remains Steady Within Key Range

The 12-hour Bitcoin chart shows BTC trading at $106,881, holding above the key $103,600 support level that has acted as a base since late May. Despite recent volatility caused by geopolitical tensions and macroeconomic uncertainty, Bitcoin remains in a consolidation zone between $103,600 and $109,300, respecting both the lower and upper boundaries of this range.

Price is currently pushing off the 100-day SMA (green line), indicating that buyers are stepping in at dynamic support levels. A bullish crossover of the 50-day and 100-day SMAs further supports short-term upward momentum. However, BTC is still trading below the $109,300 resistance, which continues to act as a strong supply zone. A decisive breakout above this level could confirm trend continuation and set the stage for another test of the all-time high at $112K.

Volume remains relatively stable but lacks the strength seen in prior impulsive moves. If Bitcoin can build momentum and close above $107K with strong buying volume, it may pave the way for a breakout. On the downside, a loss of $103,600 would invalidate the current structure and likely lead to further retracement toward the 200-day SMA, currently near $94,000. For now, the structure favors patient bulls.

Featured image from Dall-E, chart from TradingView