After a brief period of upward trend, Bitcoin, the largest cryptocurrency asset, has flipped into bearish territory, recording a nearly 4% decrease in the past day. While BTC may have shown weakness in its price dynamics, the flagship asset has performed exceptionally in its Spot ETFs.

ETF Investors Unshaken By Bitcoin’s Decline

Bitcoin’s price continues to face heightened negative movements as it drops to key support zones. However, other key aspects like the Spot Bitcoin Exchange-Traded Funds (ETFs) have been persistently experiencing a bullish trend.

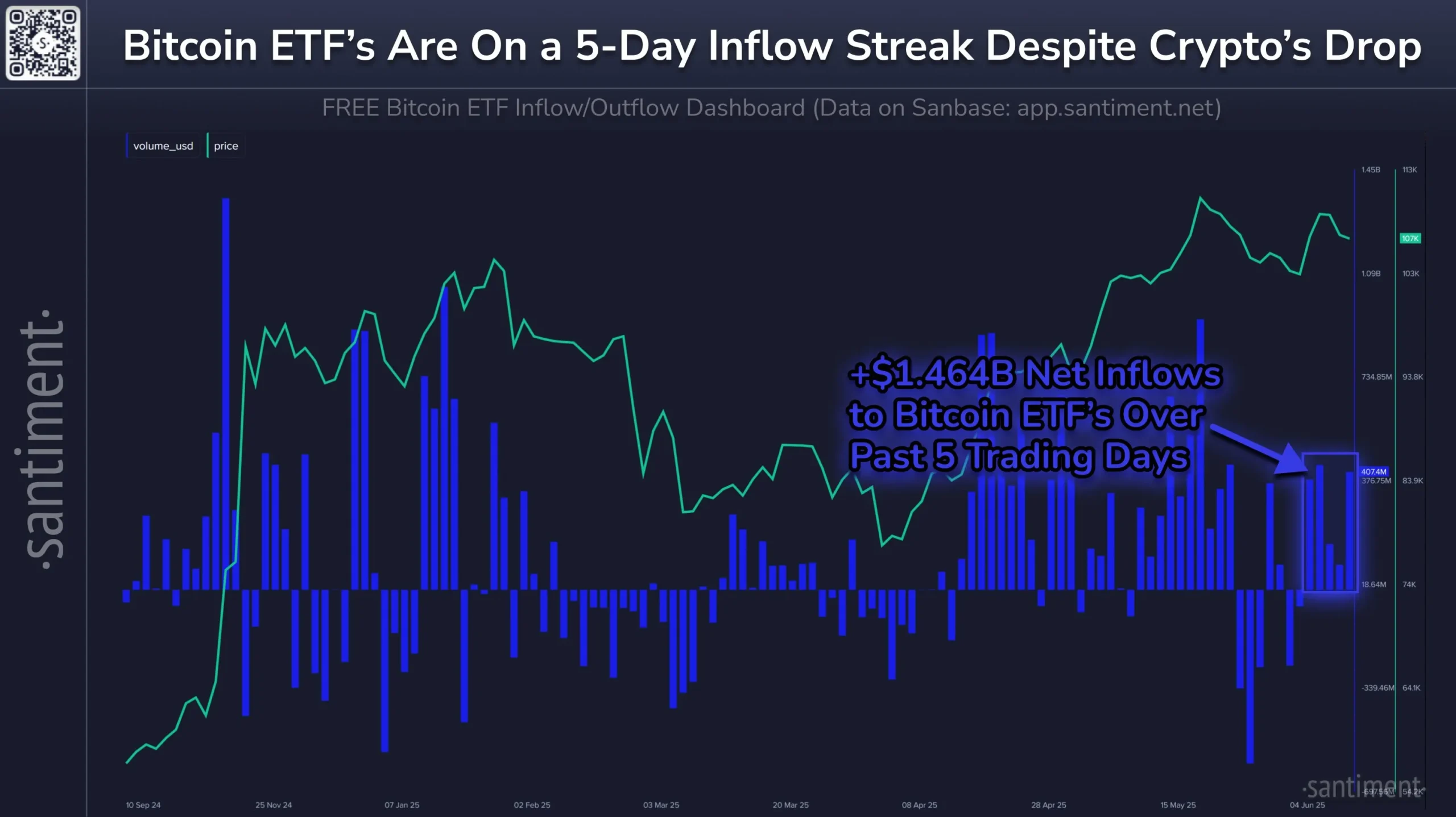

Santiment, a leading on-chain data analytics firm, reported that there have been steady, notable inflows into the Spot BTC ETFs in the past few days. The steady inflows to the spot BTC ETFs come as BTC gradually loses its recent upward trend that led to a new all-time high.

According to the on-chain platform, the products still enjoyed a robust inflow on Tuesday despite BTC dropping below the $104,000 level, which implies that institutional confidence was unshaken by the dip. This enduring interest in conventional finance points to a sustained belief in the potential of Bitcoin’s value proposition.

Reports from Santiment revealed that the Tuesday inflow into the spot BTC ETFs marked its 5-day consecutive inflow amid short-term price turbulence. Furthermore, combining the 5-day inflows dating back to June 9, the products’ net inflow within the time frame is valued at over $1.46 billion. BTC spot ETFs inflows display the resilience of institutional and retail investors as they position themselves for a surge, which is an indication that the bull market is still alive.

BTC Spot ETFs Inflows To Influence Price Movements?

The current inflows into the Bitcoin Spot ETFs extend beyond their 5-day consecutive influx. In an X post, Daan Crypto Trades, a technical expert and trader, revealed that the products have taken in over $5 billion in net inflows in the past month.

Interestingly, Michael Saylor’s Strategy company was seen purchasing about $2.2 billion worth of BTC while GME bought at least another +$2 billion of BTC. This massive accumulation probably supported the generation of a net inflow of more than $10 billion by ETFs and businesses.

Despite these massive inflows, the price of BTC remains unchanged from a month ago. “If the inflows keep going, then that’s good as eventually you’ll chew through the supply,” the expert stated.

However, it is possible that the inflows could become problematic if they were to halt or reverse, as seen since the ETFs went live. This is because large inflows without any price movement ultimately result in the creation of a local peak.

Sharing his long-term outlook, the expert believes that for every billion that ETFs and Saylor purchase, there are willing sellers, which is unquestionably positive over the long run. Meanwhile, in the short term, it is mostly a cause for worry when the price is not moving in tandem with massive inflows or outflows.