Bitcoin has been gradually climbing toward its all-time high of $111K, though current momentum appears limited. Still, a successful breakout above this level could trigger a short-squeeze, propelling the price toward the next potential target at $120K.

BTC Price Analysis: Technicals

By Shayan

The Daily Chart

Bitcoin has been inching closer to its all-time high of $111K but continues to show signs of waning bullish momentum.

Persistent profit-taking and intensified selling pressure at this psychological level have led to subdued volatility in recent sessions. Moreover, on-chain indicators reveal distribution among long-term holders, contributing additional supply and reinforcing resistance near the ATH.

Despite these headwinds, the current consolidation phase below $111K could serve as a launchpad for a breakout, should new demand enter the market. In the event of a bullish breakout, a short-squeeze scenario may unfold, propelling the price toward the $120K mark and potentially setting a new record high.

The 4-Hour Chart

On the lower timeframe, Bitcoin recently attempted an upward move but encountered resistance at the upper boundary of a descending wedge around $108,000. This has resulted in a low-volatility sideways structure, with the pattern’s upper trendline acting as strong resistance.

Should the price fail to reclaim this level, another rejection is likely, potentially dragging Bitcoin back toward the $100K support at the wedge’s lower boundary.

Conversely, a decisive breakout above $108K could trigger a renewed bullish wave, targeting the $111K ATH once more. While momentum remains sluggish, market structure and pattern formation suggest Bitcoin is preparing for a breakout, leaving only the timing uncertain.

On-chain Analysis

By ShayanMarkets

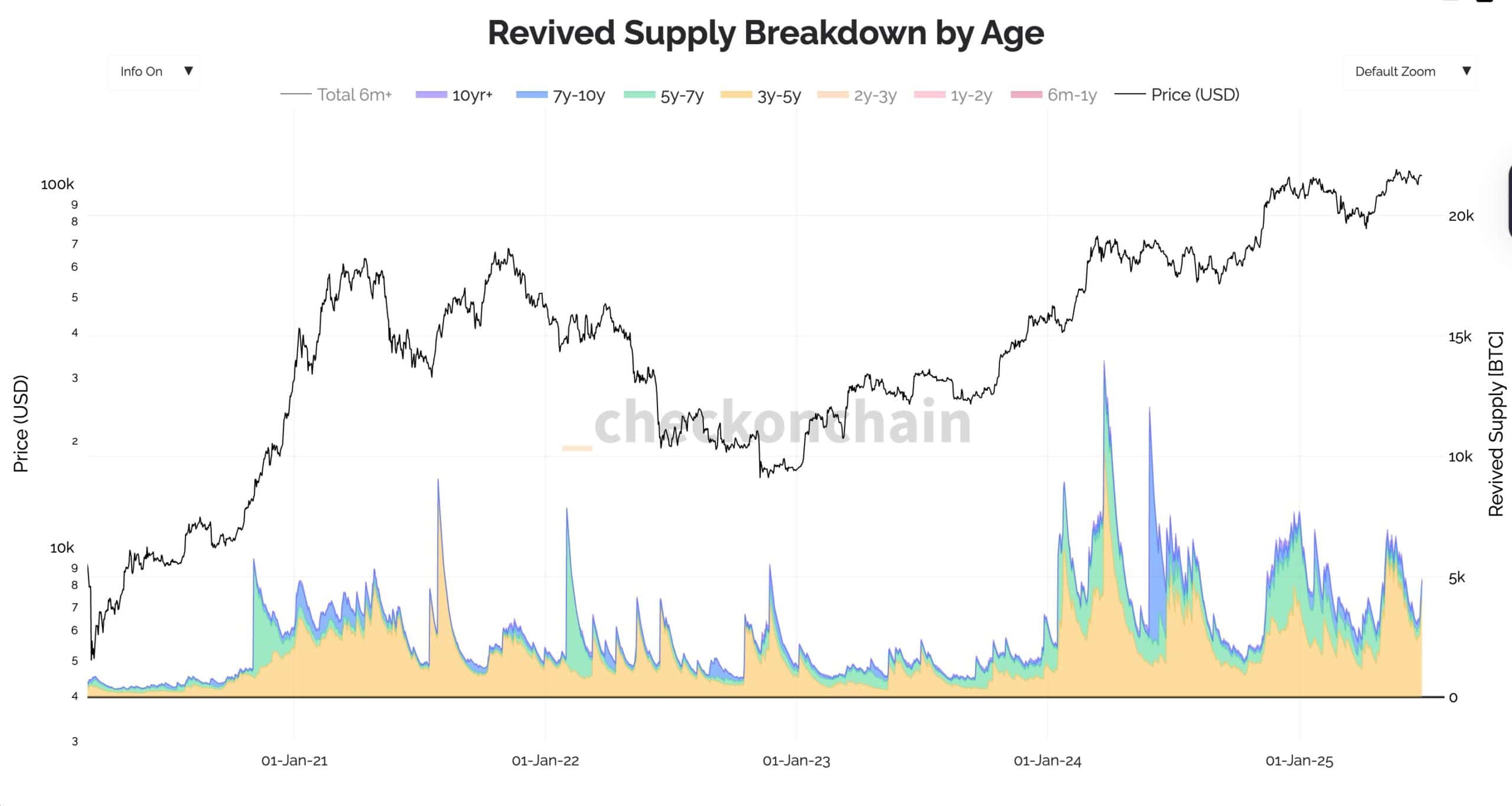

This chart provides essential insight into the volume of Bitcoin’s supply being spent or reactivated by different age bands. Amid the current static price action between $100K and $111K, many have questioned the root cause of the market’s fading momentum, and this data may offer a clear explanation.

It appears that long-term holders, those who have held their coins for over three years, are the primary contributors to ongoing selling pressure. These investors are capitalizing on substantial profits, often many times their initial cost basis, thereby placing consistent resistance on the price’s ability to climb further.

As long as this wave of profit-taking continues, upward momentum is likely to remain capped. However, if these holders begin to slow their selling and new demand enters the market, Bitcoin could break above the $111K barrier, triggering a potential short-squeeze and opening the door to further price discovery.

The post Bitcoin Price Analysis: BTC Needs to Break This Level to Explode to $120,000 appeared first on CryptoPotato.