TL;DR

- Some metrics signal that the BTC may be overheated and due for a short-term correction.

- Among the bearish signals is the recent behavior of the miners, who have sold over 3,000 BTC in less than a week.

Can the Bears Regain Control?

Bitcoin (BTC) took center stage today (July 14), with its price reaching a historic peak of over $123,000. Its market capitalization exceeded $2.4 trillion, thus flipping Amazon and becoming the fifth-largest asset in the world.

The rally has undoubtedly infused a huge enthusiasm across the crypto community, and many expect the bull run to continue in the following days and weeks. However, investors should also be cautious, as there are some important factors suggesting that BTC could reverse its trajectory soon.

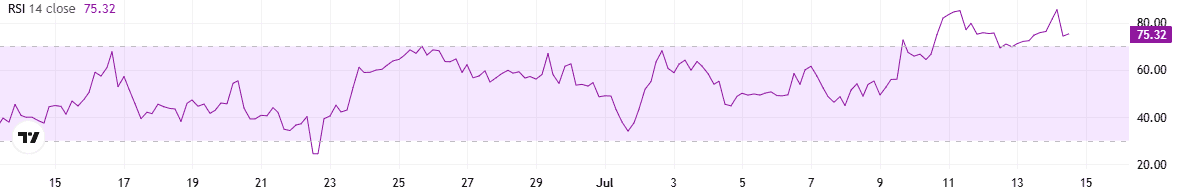

One such element is the Relative Strength Index (RSI), which has entered bearish territory at around 75. This indicates the valuation has risen too quickly over a short period and may be poised for a correction.

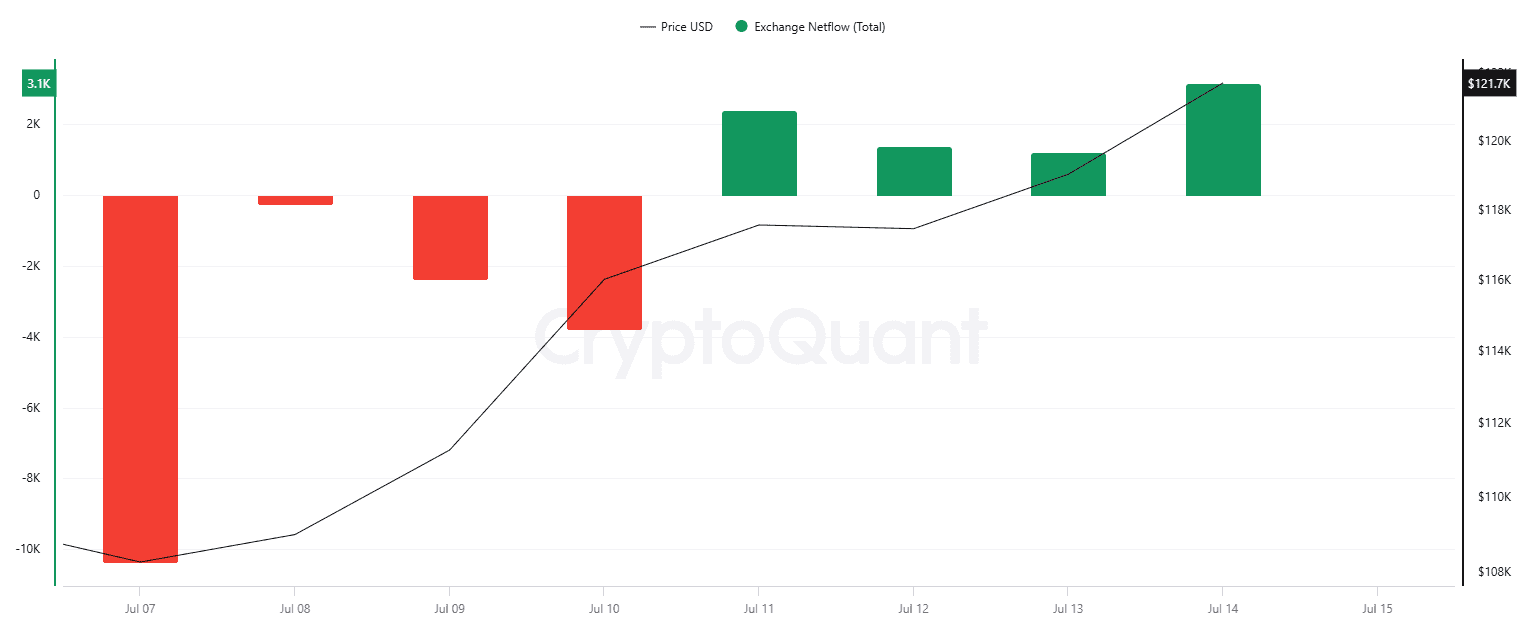

Next on the list is BTC’s exchange netflow. The graph below shows that in the last four days, inflows have surpassed outflows, which usually leads to increased selling pressure.

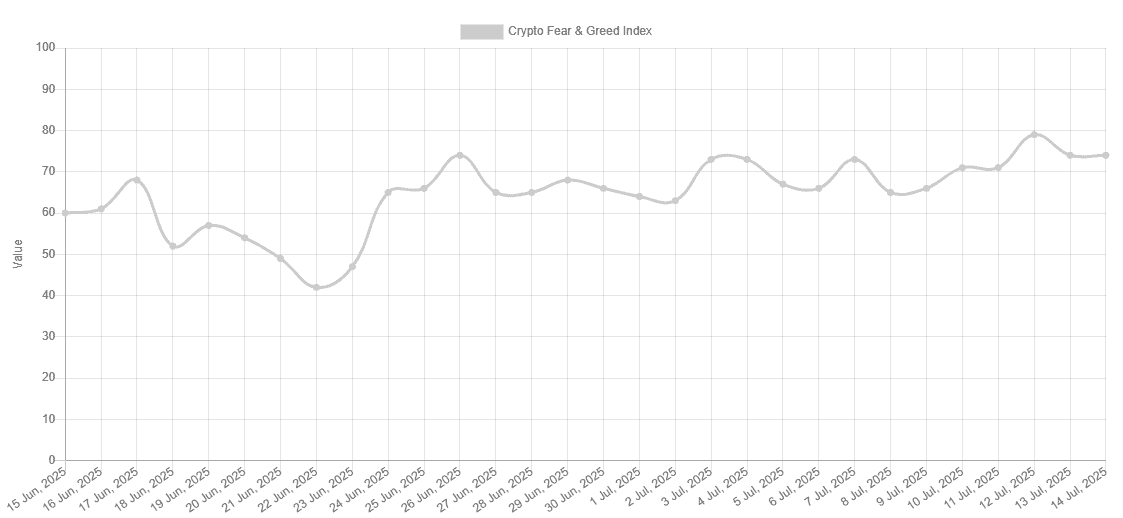

We now shift attention toward BTC’s Fear and Greed Index, which has remained in Greed or Extreme Greed territory since the end of June.

This reflects rising optimism and growing demand for the asset, though it’s worth remembering that the crypto market is notoriously unpredictable, and the prices often move against the crowd’s expectations.

Bonus: the Miners

Another bearish factor is the recent activity of the miners. The popular X user Ali Martinez revealed that those industry participants have offloaded over 3,000 BTC in less than a week.

Miners have sold over 3,000 Bitcoin $BTC since Thursday! pic.twitter.com/8Y0rLAW0I5

— Ali (@ali_charts) July 14, 2025

Sell-offs of that type could reflect a lack of confidence by the miners or their desire to take profits during the price pump. Either way, this leads to increased supply on the open market, which might be followed by a dip if demand doesn’t react accordingly.

This demand, though, has been more than evident in the past few weeks. As reported yesterday, even smaller investors, such as those referred to as “shrimps,” “crabs,” and “fish,” have been accumulating more BTC per month than the average production by all miners.

The post Is Bitcoin’s Rally at Risk? 4 Warning Signs After the ATH appeared first on CryptoPotato.