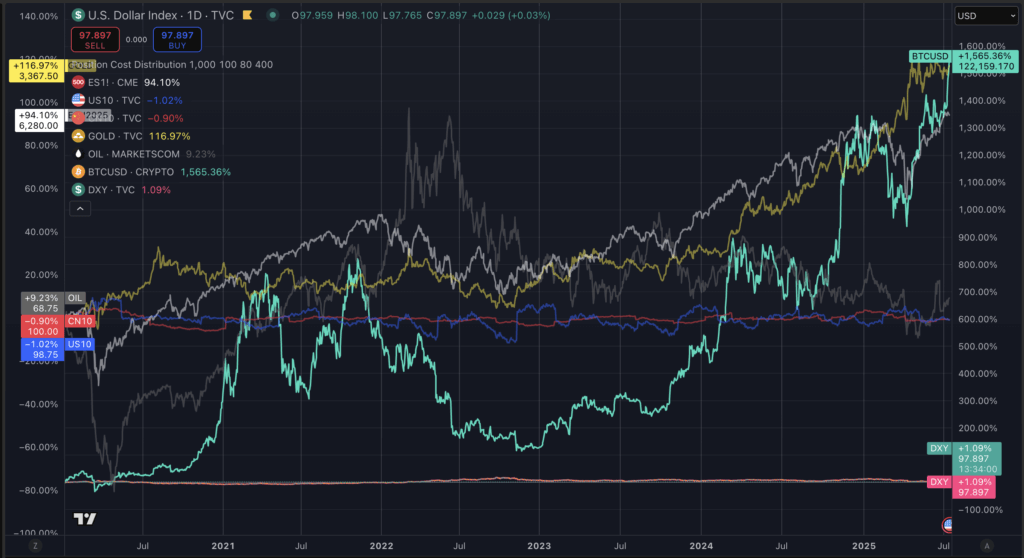

Bitcoin has outpaced traditional benchmarks since 2020, registering gains exceeding 1,500%, while gold advanced roughly 115% and the U.S. Dollar Index remained nearly flat.

The divergence in asset performance reflects a period of monetary expansion, persistent inflation concerns, and evolving perceptions of scarce, non-sovereign assets as institutional investors and sovereign entities re-evaluate reserves and portfolio allocations.

Bitcoin climbed from price levels near $7,700 in early 2020 to intraday highs around $122,600 in July 2025, driven partly by spot exchange-traded funds in the United States that removed barriers to institutional participation.

As BlackRock’s iShares Bitcoin Trust exceeded 700,000 BTC in holdings and surpassed $88 billion in assets under management, the asset class has been increasingly woven into regulated investment products. Institutional access is regarded as creating a price floor while mitigating the volatility traditionally associated with digital assets.

Gold’s upward trajectory continued through the same period, rising from around $1,550 per ounce to over $3,300, as geopolitical tensions and inflation protection strategies preserved demand for physical assets.

Meanwhile, the dollar’s relative value against other currencies remains flat after substantial volatility. Still, its purchasing power has eroded by an estimated 20% cumulatively from 2020 to 2025 due to inflation, according to data from U.S. government sources and CPI indexes.

The COVID-19 pandemic and subsequent economic policy responses in 2020 fueled an expansion of monetary supply and fiscal interventions unprecedented in modern history, prompting market participants to seek stores of value beyond fiat.

We are now walking the path toward Hyperbitcoinization

Bitcoin’s fixed supply and decentralized nature positioned it as both a speculative vehicle and a potential hedge, capturing capital from investors diversifying away from sovereign currency exposure.

Bitcoin’s acceleration has led many to explore the thesis of Hyperbitcoinization, where it might replace fiat currencies as a primary medium of exchange and store of value. While the prevailing analyses maintain this scenario remains improbable in the near term, today’s environment mirrors how fiat currencies’ fall would start.

Bitcoin has become a macro asset comparable to gold rather than an imminent replacement for the dollar. Regulatory frameworks, taxation requirements mandating fiat settlement, and the economic risk of deflation inherent in fixed-supply monetary systems remain substantial hurdles to Bitcoin fully supplanting traditional currencies.

Institutions and governments have nonetheless integrated Bitcoin into treasury strategies. As CryptoSlate has reported, the Emirate of Abu Dhabi disclosed a $439 million position in Bitcoin ETFs. In the United States, President Trump signed an executive order initiating a Strategic Bitcoin Reserve, signaling official sector interest in holding Bitcoin alongside traditional reserves.

Further complicating the outlook, U.S. trade policy in 2025 has introduced tariffs on major trading partners, contributing to inflationary pressures and leading to a decline of around 10% in the dollar index year-to-date. BlackRock CEO Larry Fink cautioned in public statements that persistent fiscal deficits and the risk of dollar debasement could elevate digital assets like Bitcoin as alternatives, reflecting sentiment from parts of the financial establishment that Bitcoin’s role is shifting from speculative asset to strategic reserve.

Currently, the total US debt stands at $37 trillion and rising, while the dollar is in a precarious position.

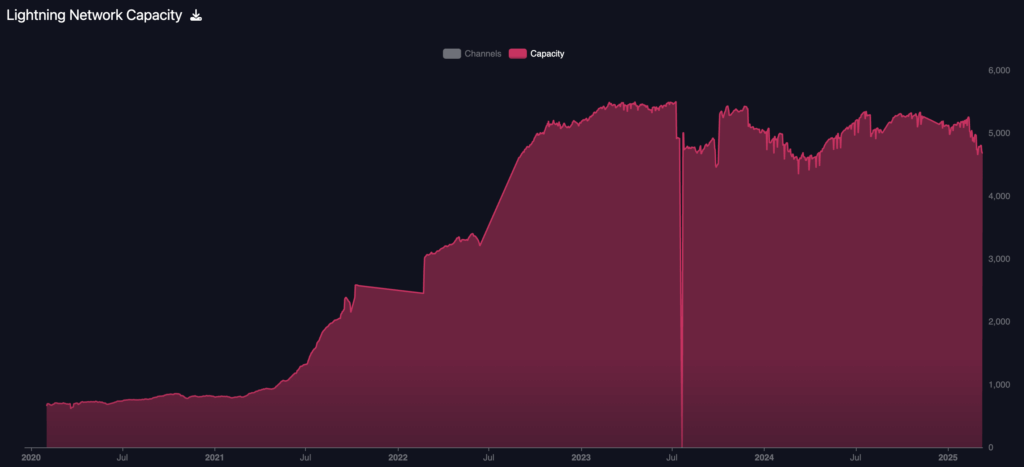

Surging institutional adoption has coincided with declining evidence of grassroots activity. On-chain throughput broke above 500,000 transfers a day several times in 2025, though Lightning Network capacity has remained relatively flat around 5,000 BTC since mid-2022.

However, the past few months have seen a drop in capacity to around 4,300 BTC, according to mempool.space.

Transfers below $1,000 do make up more than half of the total on-chain Bitcoin volume, pointing to peer-to-peer settlement rather than exchange consolidation.

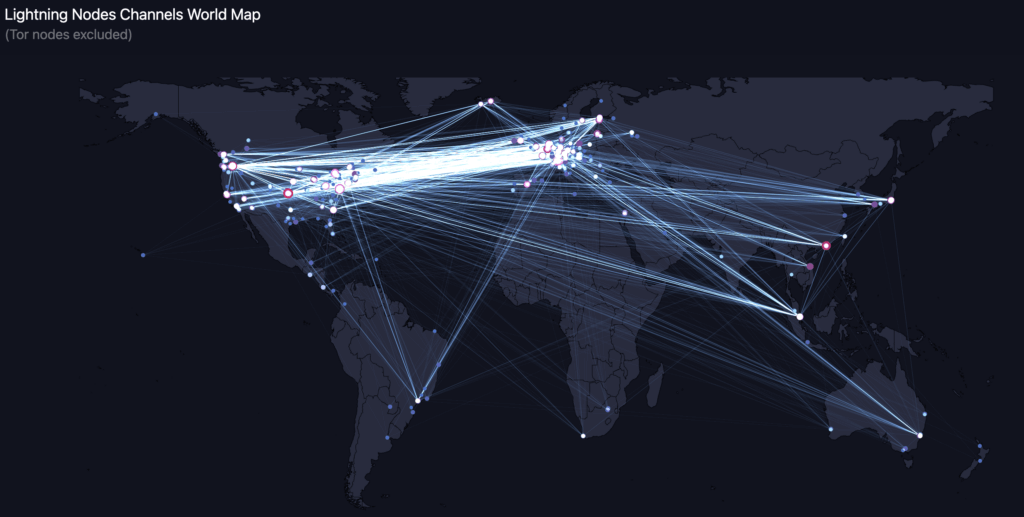

Those metrics, paired with ETF inflows, corporate treasury adoption, Abu Dhabi’s allocation, and the U.S. strategic reserve order, create a picture that matches the early stage of Hyperbitcoinization: fiat dilution, a stronger Bitcoin price, and the first migration of day-to-day transactions onto a rival monetary rail. Further, the Lightning Network is not the only way to move Bitcoin on-chain cheaply, numerous layer-1s host forms of wrapped Bitcoin which are used regularly across multiple chains.

If throughput on Lightning and other layers widens further, the framework for mass transactional adoption will be in place, and Bitcoin’s role will move from balance-sheet hedge to usable money.

That transition is underway, but the focus remains on acquiring Bitcoin rather than integrating Bitcoin as a technological tool to revolutionize TradFi.

Still, if the corporate world relies on Bitcoin for its store of value, placing that value in Lightning Channels to earn yield or staking it to secure other blockchains becomes an enticing offer.

From there, using Bitcoin to secure critical infrastructure and building tech stacks around Bitcoin’s immutable global timestamping service is a logical next step.

At that point, Bitcoin becomes not only the best store of value but the catalyst to secure and integrate that value into the entire digital world.

The post This is what fiat death looks like. Bitcoin’s 1,500% boom paves the path to Hyperbitcoinization appeared first on CryptoSlate.