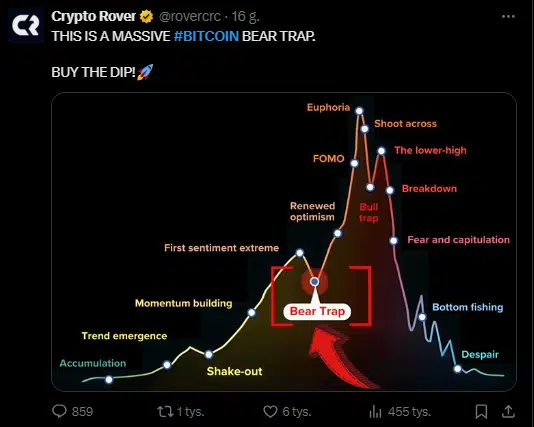

The cryptocurrency market has once again experienced a dramatic turn of events. Bitcoin has dropped to around $86,000, its lowest price in three months. Investor anxiety is rising, with over $1.59 billion liquidated in just 24 hours. Some see this as the start of a deeper downturn, while others call it a „once-in-a-generation” opportunity to buy BTC at a discount. Is this optimistic thinking, or is it simply a pragmatic, calculated approach?

Bitcoin at Rock Bottom? Fear, Inflation, and Trump Fuel Market Panic

What triggered this sell-off? Analysts point to weak performance on the U.S. stock market, rising inflation, and declining consumer sentiment. According to Conference Board data, the Consumer Confidence Index fell to 98.3 points, marking the largest monthly drop since August 2021. The situation remains complex and uncertain.

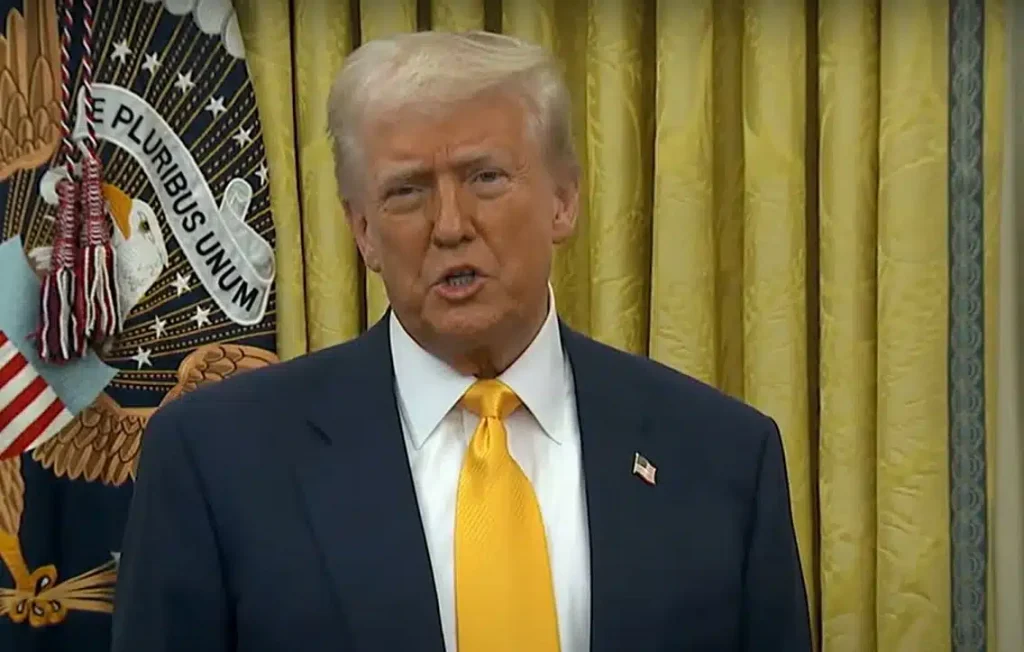

Additionally, Donald Trump’s new tariffs on imports from Canada and Mexico could temporarily weaken the economy, pushing investors away from riskier assets like cryptocurrencies.

BTC in the „Generational Buy” Zone – Time to Buy?

Is the situation as bad as some pessimistic analysts claim? Despite the short-term panic, some experts suggest taking a broader view.

The Relative Strength Index (RSI) for Bitcoin has dropped below 27, a level that historically signals an oversold market and a buying opportunity. The last time RSI was this low was in August 2024, when BTC fell to $49,000—and what followed? A strong rally.

Andre Dragosch, an expert at Bitwise, notes that we are still in the early stages of a post-halving bull market. According to his analysis, the biggest gains are still ahead.

Another bullish signal is the growing number of Bitcoin holdings on publicly traded company balance sheets. Analyst Tuur Demeester points out that institutional investors continue accumulating BTC, seeing the dip as a buying opportunity rather than a reason to panic.

Final Thoughts

So, should investors buy the dip or stay away from falling knives? As always, a balanced, rational approach is the best strategy.