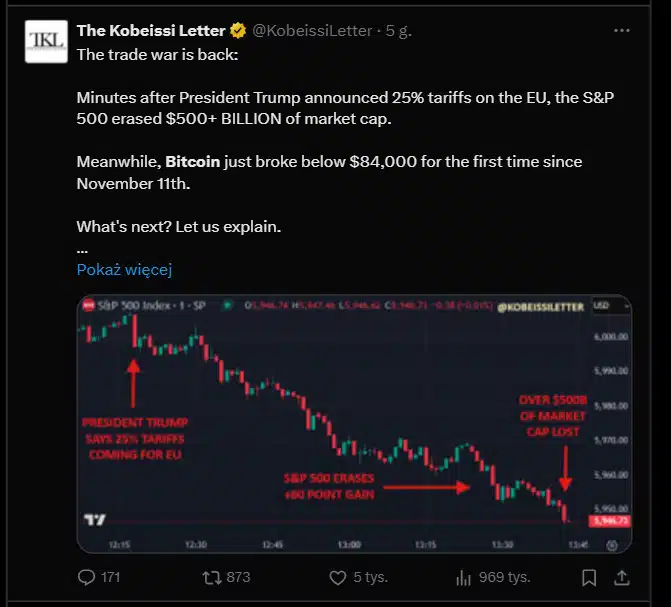

Markets in Turmoil as Trump Stands Firm on Tariffs

Markets reacted with panic after Donald Trump made it clear that he has no intention of rolling back tariffs. Duties on Canada and Mexico will take effect on April 2, and he has also threatened 25% tariffs on European imports, including automobiles and other goods. As a result, the dollar and bond yields surged, while Wall Street and cryptocurrencies plunged.

Bitcoin briefly tested the $83,000 level, as concerns over rising inflation in the U.S. mounted. The possibility of record-breaking tariffs has only fueled these fears. Trump has also warned of 100% tariffs on BRICS nations if they move away from the dollar—a scenario that could further complicate the Federal Reserve’s path toward its inflation target.

Trump Shakes Up Wall Street

Regarding Ukraine, Trump stated he is ready to sign a final agreement with Putin and Zelensky. However, he insists that Ukraine must abandon its NATO ambitions, and the U.S. will „recover its money” through deals involving Ukrainian resources. Whether the deal will bring a definitive resolution remains uncertain, as Zelensky has expressed skepticism. Trump also noted that discussions on lifting sanctions on Russia will only take place once peace in Ukraine is secured. Meanwhile, the U.S. and Russia are considering cooperation in Arctic trade routes and exploration.

Trump remained vague about Taiwan, simply stating that the U.S. aims to have „good relations with China, Russia, and the Middle East.” Notably, he made no mention of Europe, once considered America’s closest ally. Markets fear that these tariffs could bring higher inflation to the U.S. Additionally, comments from Commerce Secretary Howard Lutnick and other officials suggest that the administration is still debating whether to raise tariffs on China, which currently stand at 10%.

Economic Uncertainty and Inflation Fears

Recent U.S. economic data has raised concerns. Consumer sentiment and retail sales have both come in weaker than expected, while inflation expectations have surged to 4.2%-5%, compared to just under 3% a year ago. This is likely to keep the Federal Reserve from making any policy changes throughout 2025—unless, of course, the economy falls into a recession.

For investors, the biggest worry remains the unpredictability of the new administration’s trade policies. The average U.S. tariff rate could surpass 20%, a level unseen in decades. While tariffs pose challenges for the U.S., they could be even more devastating for economies heavily reliant on American trade, such as Mexico and Canada.

Nvidia Reports Strong Earnings, but Growth Slows

Meanwhile, Nvidia, the world’s second-largest company and a dominant force in AI, reported its earnings for the last quarter of 2024. While revenue and profit exceeded expectations, the pace of growth is slowing. The company also forecasted weaker margins and a 9% revenue increase for the current quarter, down from 12% in Q4 2024. As a result, Nvidia’s stock closed slightly lower in after-hours trading.

- Revenue: $39.3 billion (est. $38.25 billion)

- Adjusted EPS: $0.89 (est. $0.84)

- Data Center Revenue: $35.6 billion (est. $34.09 billion)

- Networking Revenue: $3.02 billion (est. $3.51 billion)

- Computing Revenue: $32.56 billion (est. $30.41 billion)

- Gaming Revenue: $2.5 billion (est. $3.02 billion)

- Gross Margin: 73.5% (in line with estimates), forecasted to decline to 70.5%-71.5% in Q1 (est. 72.1%)

The company’s Blackwell AI chips generated $11 billion in sales for Q1 2025, and total revenue is projected at $43 billion (±2%), slightly above estimates of $42.3 billion.

Despite strong earnings, CEO Jensen Huang’s comments failed to spark market enthusiasm, as concerns over slowing growth persist.

Thank you for reading our article to the end.