Panama City’s mayor stirred up talk this week when he hinted at building a city‑level Bitcoin fund. It all started with a single line on social media.

Mayer Mizrachi wrote “Bitcoin Reserve” on X on May 16. He’d just met with Max Keiser and Stacy Herbert, two of the big names behind El Salvador’s Bitcoin moves.

Meeting Sparks Curious Talk

According to local sources, Mizrachi sat down with Keiser and Herbert to go over the nuts and bolts of Bitcoin policy. The mayor was tight‑lipped about details.

But the timing was notable. He shared that post just before heading to the Bitcoin 2025 conference in Las Vegas. It seemed like a heads‑up that something more could be coming.

Bitcoin Reserve

— Mayer Mizrachi (@Mayer) May 16, 2025

Legal Hurdles Ahead

Based on reports, creating a formal Bitcoin reserve would need a vote in Panama’s National Assembly. Lawmakers would have to write and approve a bill first. That process can drag on.

Committees must study the idea. There’d be debates, amendments and budget checks. Only then could the city hold any stash of Bitcoin on its books.

Panama City to introduce El Salvador’s “What is Money” financial literacy schoolbooks to their new digital libraries.

A regional Central American bitcoin block is emerging!

— Stacy Herbert

(@stacyherbert) May 15, 2025

Energy Plans Discussed

Energy was also on the table. Keiser pointed out Panama’s hydroelectric potential and El Salvador’s geothermal plants. He suggested that green energy could power Bitcoin mining rigs.

It’s a neat idea: use cheap, clean power to run the computers that keep the Bitcoin network ticking. But permits and grid upgrades would be needed. Companies and regulators would have to sign off.

Crypto Payments On The Horizon

Mizrachi has already said Panama City will accept Bitcoin, Ether, Tether and USDC once the payments system is ready. That means building the crypto‑to‑fiat rails. Banks or fintech partners must handle the exchange.

And secure wallets would be needed to store any coins the city takes in. No launch date’s been set. But the plan is on the agenda.

Companies Bulk Up Holdings

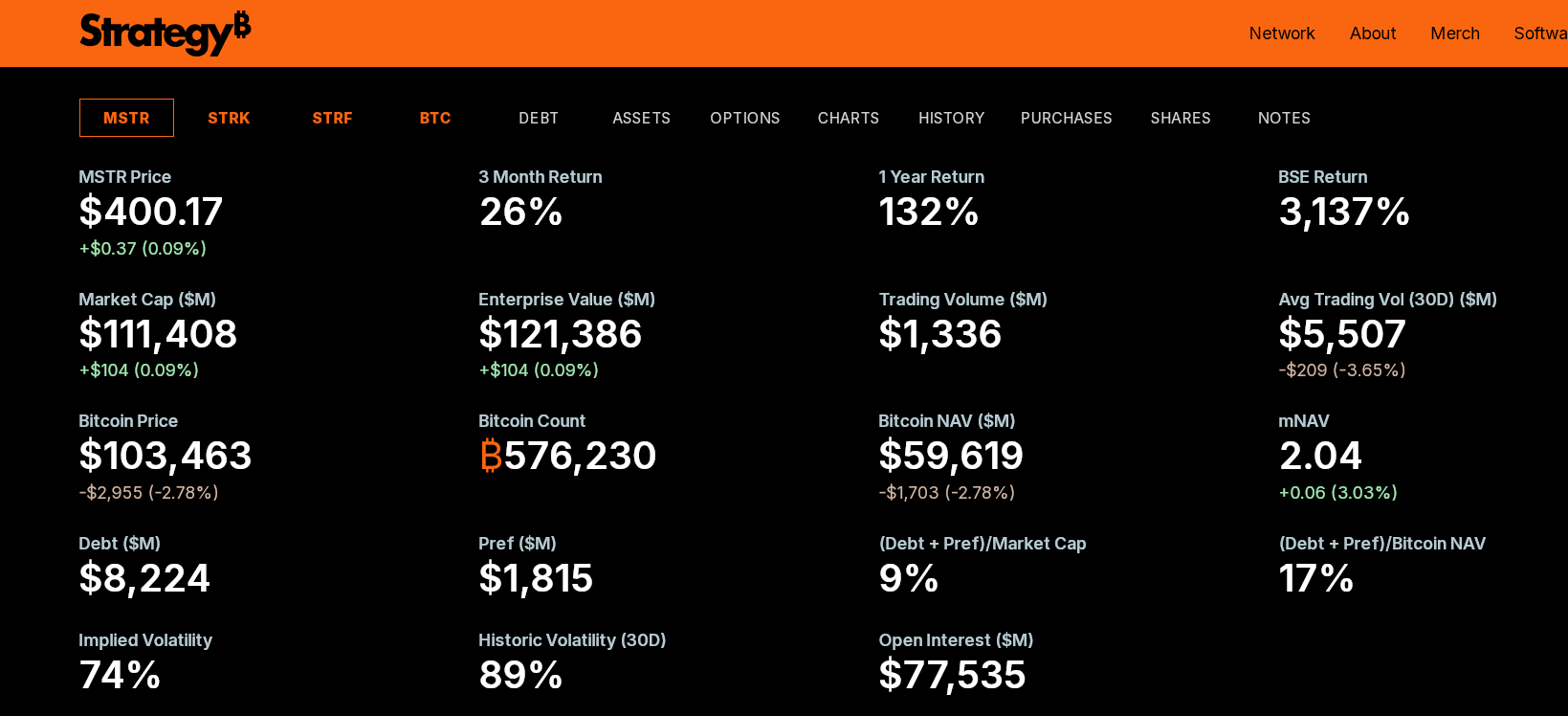

It’s not just governments eyeing Bitcoin. Public firms are piling in, too. Michael Saylor’s Strategy Corp. just said it would raise $84 billion to buy more Bitcoin. That includes selling another $21 billion in stock.

They’ve also lifted their debt limit from $21 billion to $42 billion, with $14.6 billion still open. On the other side of the globe, Metaplanet added 1,240 BTC—about 18.50 billion yen, or roughly $127 million. That brings its total to 6,797 BTC, now worth just over $706 million.

Based on reports, publicly listed firms increased their Bitcoin stash by 15% in Q1. It shows that many see Bitcoin as a core holding—not just a side bet.

Featured image from Unsplash, chart from TradingView