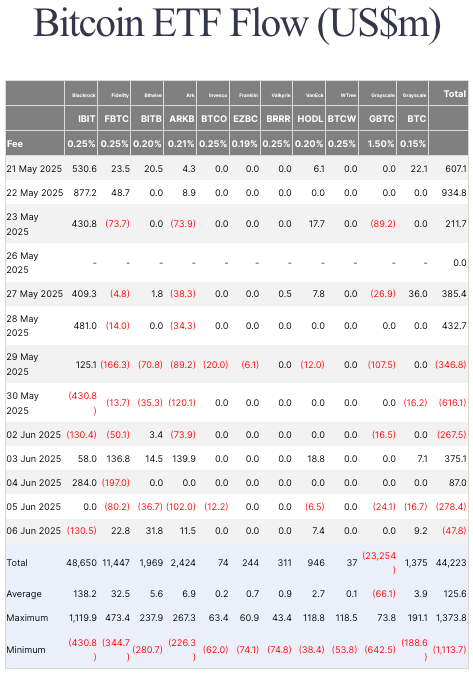

Spot Bitcoin ETFs have struggled to keep the inflow momentum they established in May. The first trading day of the month ended with a $267.5 million outflow, which followed the massive $616.1 million outflow on May 30.

Another $278.4 million outflow on June 5 and a smaller $47.8 million on June 6 effectively erased the two days of inflows ETFs saw this month. June 3 and June 4 saw modest inflows of $71.3 million and $375.1 million, respectively.

The outflows from Grayscale’s GBTC remain a consistent drag, with $278.4 million exiting the fund between June 1 and June 6 alone. BlackRock’s IBIT has historically dominated inflow charts, contributed only $82.2 million in that period, reinforcing the slowdown.

This drop in activity comes as Bitcoin’s price hovers tightly in the $104,000 to $106,000 range, failing to break past its May 22 all-time high of $111,653. Flows in May were notably more erratic, peaking at $934.8 million in net inflows on May 22, the day after BlackRock’s IBIT alone drew $877.2 million.

However, this bullish momentum quickly faded. By May 29, net outflows hit $346.8 million, followed by a sharp $661.1 million withdrawal on May 30, marking the largest single-day net outflow since ETFs launched in January. These outflows reflected a market struggling to hold above $109,000 as spot demand thinned.

June flows so far seem to be a result of Bitcoin’s narrow trading range, with prices constrained mainly between $104,000 and $106,000 since the beginning of the month.

This supports the theory that ETF demand softens when Bitcoin enters a period of price inertia (even if it’s near its ATH). With volatility low, ETF investors appear hesitant to increase exposure. That inertia stands in stark contrast to the strong flows observed in mid-May when price action was aggressive and bullish conviction was high.

However, with Bitcoin rallying at the start of this week, should the price continue or hold around $107,000 at US market open, today could see renewed inflows into spot ETFs.

The post Bitcoin ETFs could see reversal this week after retreat in first week of June appeared first on CryptoSlate.