📉 Bitcoin Struggles as ETFs See Outflows

- On March 4, Bitcoin ETFs recorded $143.5 million in outflows, signaling a cautious approach from investors.

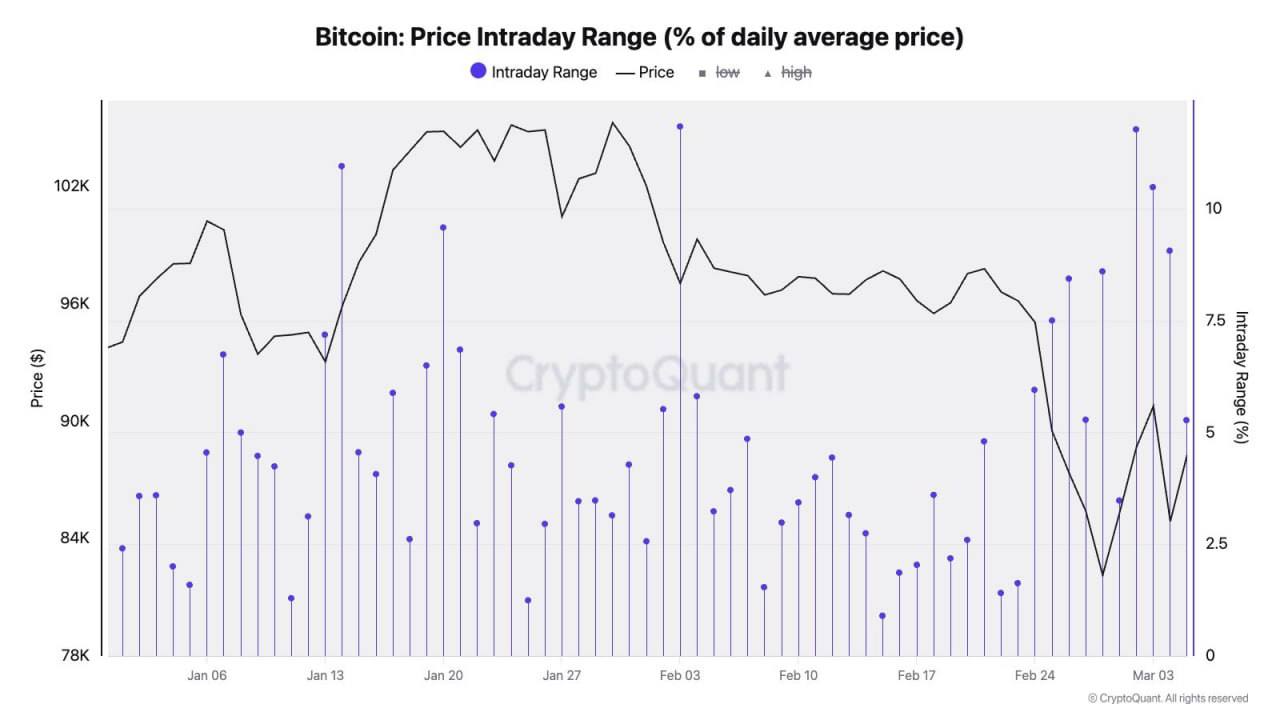

- A total of 1,660 BTC was sold, possibly contributing to recent price volatility.

- This could indicate profit-taking after Bitcoin’s previous rally or uncertainty about its near-term direction.

📈 Ethereum Gains Momentum with ETF Inflows

- In contrast, Ethereum ETFs saw $14.6 million in inflows, suggesting renewed confidence in ETH.

- Investors bought 6,800 ETH, potentially anticipating spot ETH ETF approvals or upcoming network upgrades.

🔄 Market Shift or Temporary Rotation?

- The contrasting flows suggest a possible sectoral rotation within crypto investments.

- While Bitcoin faces short-term headwinds, Ethereum appears to be gaining favor.

- The coming weeks will determine whether this trend continues or if BTC regains momentum.

📊 What’s next?

- Will Bitcoin bounce back, or is Ethereum set to take the lead?

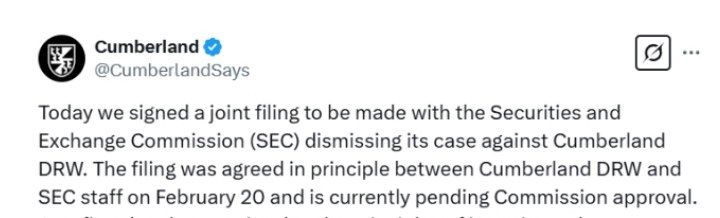

- Investors will closely watch macro trends, ETF flows, and regulatory developments for the next big move.