The Israel-Iran conflict has triggered a wave of speculation across the crypto sector, with traders pouring millions into prediction markets.

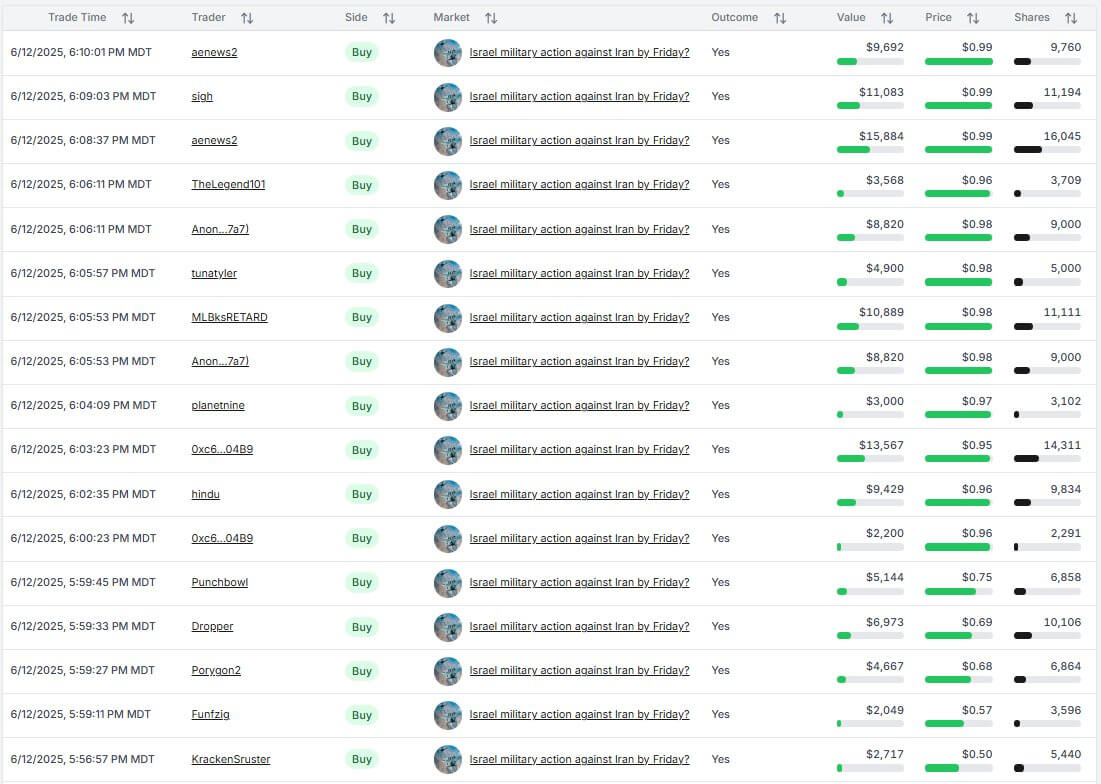

On Polymarket, a decentralized platform that allows users to wager on real-world outcomes, betting volume linked to the crisis has now exceeded $7 million across over 20 markets.

Tensions escalated sharply on June 13 when Israel carried out a preemptive strike on Iranian targets. The operation reportedly aimed at crippling Iran’s nuclear program and missile capabilities and resulted in the deaths of high-ranking military officials and nuclear scientists.

Israel-Iran faceoff spikes Polymarket volume

Polymarket data shows that this dramatic development has fueled intense activity. Participants have placed over $1 million in bets in one market on whether Iran will retaliate with military action before midnight on June 13. Current sentiment assigns this outcome a 47% probability.

Others are betting on a slower timeline. Nearly $661,000 has been wagered on the belief that Iran will strike back before the end of June. Traders in this camp estimate an 89% likelihood that the conflict will continue to unfold in the coming weeks.

Another major theme is the risk of the conflict widening to draw in the United States. Polymarket users have staked around $1.48 million on the possibility of US military action against Iran before July. This scenario currently carries a 25% chance according to market signals.

Separately, more than $2 million has flowed into bets concerning the prospects of a new US-Iran nuclear agreement being brokered before July. However, confidence in this outcome remains low, with markets pricing it at under a 10% likelihood.

Community reaction

The surge in geopolitical betting reflects a broader trend within crypto markets. Traders increasingly use the blockchain-based platform to speculate on high-profile global events in pursuit of profit.

Meanwhile, Shayne Coplan, Polymarket’s CEO, suggested that the platform users see it as a news site and not a gambling avenue because they are kept abreast of what is happening worldwide.

Yet this activity is not without controversy. Polymarket’s facilitation of bets on an active and deadly conflict has drawn criticism from observers who argue that such markets risk trivializing human suffering for financial gain.

The post Israel-Iran tensions trigger over $7 million crypto betting volume spree on Polymarket appeared first on CryptoSlate.