Two wallets linked to Solana-based Kled AI (KLED) moved 58.25 million KLED out of an address between May 31 and June 7, then dispersed the tokens across 99 new wallets a few days after announcing a buyback plan.

According to a June 10 report by Dashcoin Research founder Nicholas Wenzel, the amount moved was worth $800,000, which dwarfs KLED’s first public buyback of $50,000 announced on May 28.

Along with the initial purchase, Kled AI pledged to continuously repurchase tokens from the market as part of a $500,000 buyback plan.

On-chain analysis by CryptoSlate found that KLED-related wallets converted most of the tokens to USDC and sold approximately $221,000 via ChangeNow.

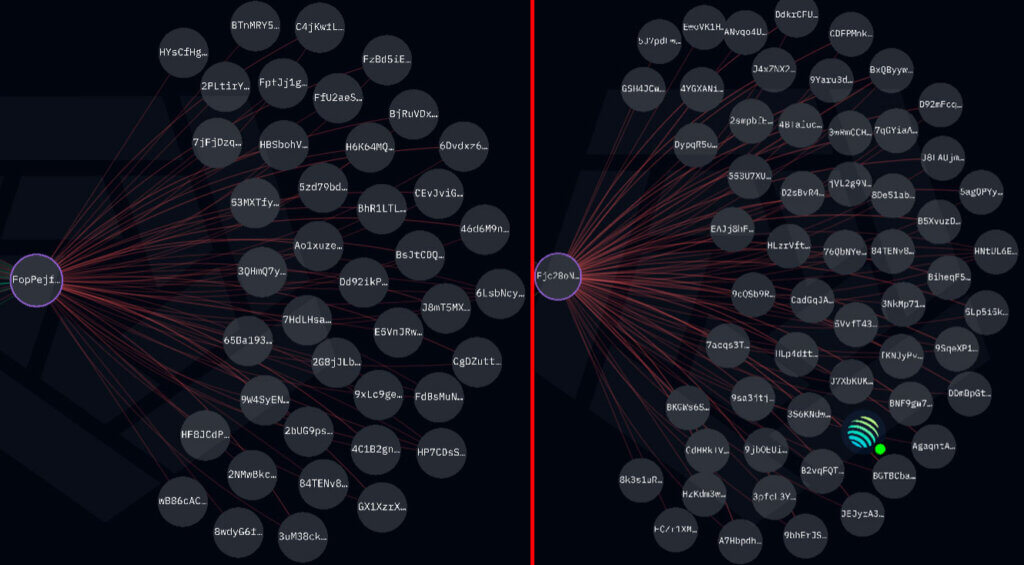

On-chain relation between the wallets

Wenzel claims that wallets Ejc28…1ax15 and FopPe…d3UMR have a relation with the team behind KLED.

On-chain data suggests this relation, as KLED’s deployer first funded both wallets.

Following the funding by the deployer address, the wallets received tokens from address 52T4z…kxyvJ, which Kled AI founder Avi Patel said on June 11 is the wallet responsible for liquidity provider rewards.

Ejc28 received 30 million KLED and divided it amongst 56 wallets. However, only 27 of them received $10,000 or more.

At the same time, FopPe received 28.25 million KLED and divided the amount among 41 wallets. As it happened with Ejc28, only 19 wallets received significant amounts of $6,000 or more.

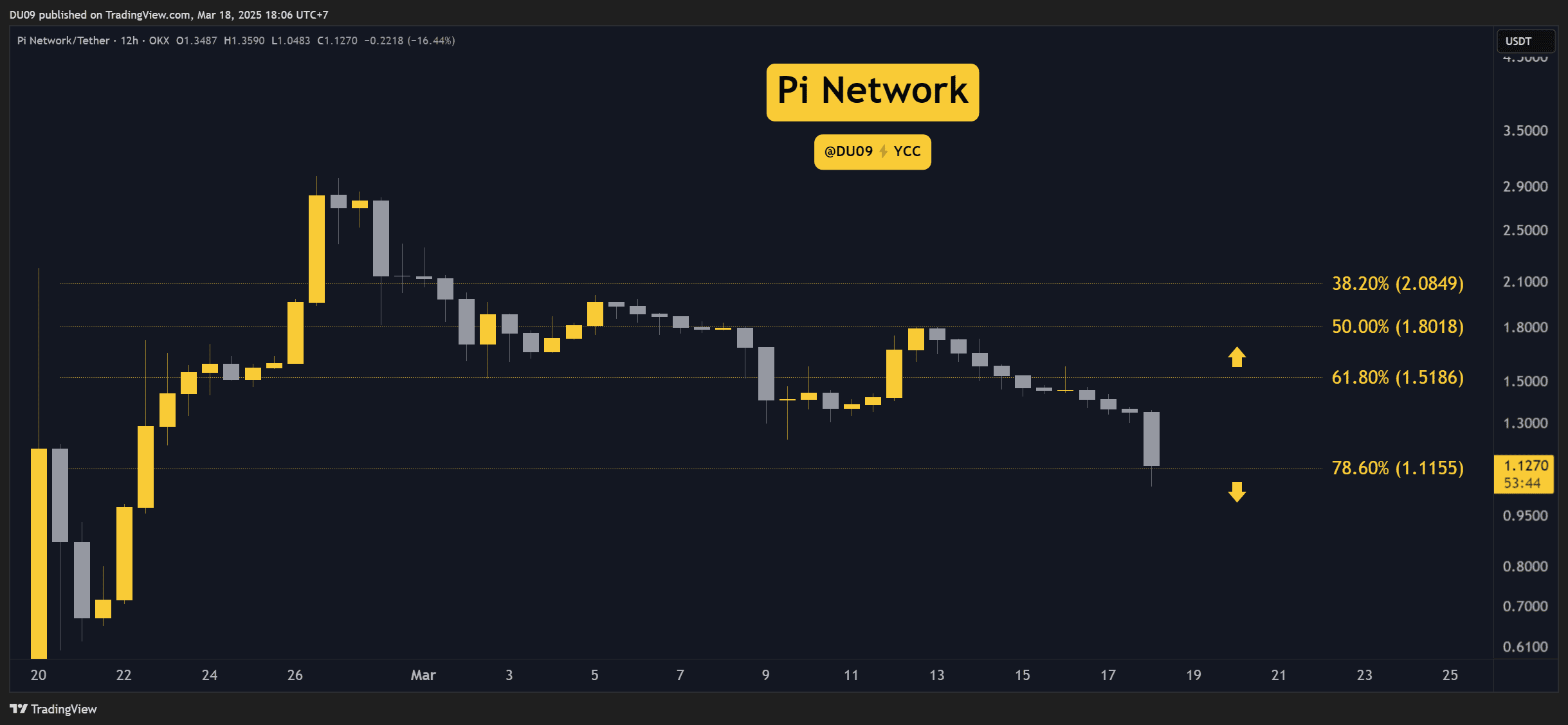

The 46 wallets that received relevant amounts of KLED then started swapping the amounts for Solana (SOL). Crossing the token sales with KLED’s price chart showed that the average correction during sales ranged between 2% and 3%.

After converting the amounts, another batch of swaps occurred, converting most of the KLED tokens into USDC.

The process occurred between June 2 and June 12.

Patel’s response

Patel confirmed the divestment in direct messages later published by Wenzel. He wrote that “we had a ton of expenses” tied to aggressive 100-day milestones and claimed the team “sold on buys so the market didn’t get hurt.”

Patel also said Believe co-founder Ben Pasternak “suggested we just smartly liquidate,” a point Pasternak allegedly denied in private messages sent to Wenzel.

Notably, while publicly replying to Wenzel on his publication, Patel said he previously clarified that the liquidation decision was “not something pushed by Believe.”

Despite addressing the token movements after Wenzel brought the matter to public scrutiny, neither Patel nor the Kled AI team communicated with the community about the token movement.

Furthermore, the amount converted to USDC represents approximately 3% of KLED’s diluted supply, which is sufficient to impact the prices significantly.

As of press time, KLED is up by nearly 30% in the past 24 hours, priced at $0.031.

State of holdings

As of June 13, the following wallets held approximately $480,000 in USDC, converted from the 58.25 million KLED:

- FoMJ6…sNosF: $108,000.

- Chfnh…LAyKv: $19,300.

- DdkrC…2DcXh: $114,600.

- GR8rS…VSuxE: $58,000.

- 2Htt7…2jTQpq: $60,700.

- EsV6yp…5iPiP: $64,000.

- HgCfA…aKXvQ: $55,000.

Notably, Chfnh’s wallet still held roughly $65,000 worth of KLED, raising the hold amount to $545,000.

Furthermore, 25 wallets had their $221,000 worth of USDC balances transferred to two different addresses associated with ChangeNOW. Considering that ChangeNOW is an exchange service, these movements were potentially withdrawals to fiat currencies.

Lastly, $81,000 from address HgCfA was converted back to 554 SOL and sent to address Crq7h…yTA1b.

This move might be related to an alleged $100,000 token buyback published by Patel on June 12, as the transaction occurred close to the publication time, and the address Crq7h was previously labeled by the Kled AI founder as the wallet responsible for buybacks.

The buyback wallet holds only $208 worth of SOL as of press time.

Interestingly, Arkham’s tracing tool showed that the conversion process for address Ejc28 typically sent the funds to intermediary wallets before transferring them to their final destination.

The broader buyback debate

Token buybacks are often marketed as the crypto analogue of corporate share repurchases, and have divided market observers.

Two notable examples are Hyperliquid’s and Jupiter’s buyback programs. Hyperliquid routes 97% of every trading fee into an autonomous Assistance Fund that continuously buys HYPE on the market.

Jupiter funnels 50% of protocol fees into hourly JUP buys, then locks the haul for three years in a vault dubbed “Litterbox.” Launched on February 17, the scheme reduces the current float while maintaining a deferred treasury, although critics note that the post-lock cliff could still yield insiders a substantial windfall.

Supporters call these mechanisms “flywheels,” but skeptics warn that the ever-present bid can also veil insider offloads unless treasury flows stay fully transparent.

Critics counter that projects with sizable pre-mines can sell into their own bid, turning buybacks into exit liquidity rather than genuine yield.

Regulators have yet to address token buybacks directly, but legal analysts warn that nondisclosure of insider selling could invite enforcement actions analogous to those in equity market insider-trading cases.

Contacted by CryptoSlate, Ben Pasternak and Avi Patel have not responded before publication time.

The post Solana AI project Kled team wallets dumps $800k tokens after promising a $500k buyback plan appeared first on CryptoSlate.