Yesterday, the US Federal Reserve (Fed) held interest rates steady for the fourth consecutive time, dampening hopes for a significant rally in risk-on assets like Bitcoin (BTC). However, on-chain indicators suggest that BTC is experiencing strong demand – potentially laying the groundwork for its next move upward.

Bitcoin Sees Strong Demand Despite Steady Interest Rates

According to a recent CryptoQuant Quicktake post by contributor Amr Taha, Bitcoin has established a solid demand zone in the mid-$100,000 range. The analyst suggests this could signal BTC’s readiness for another upward rally.

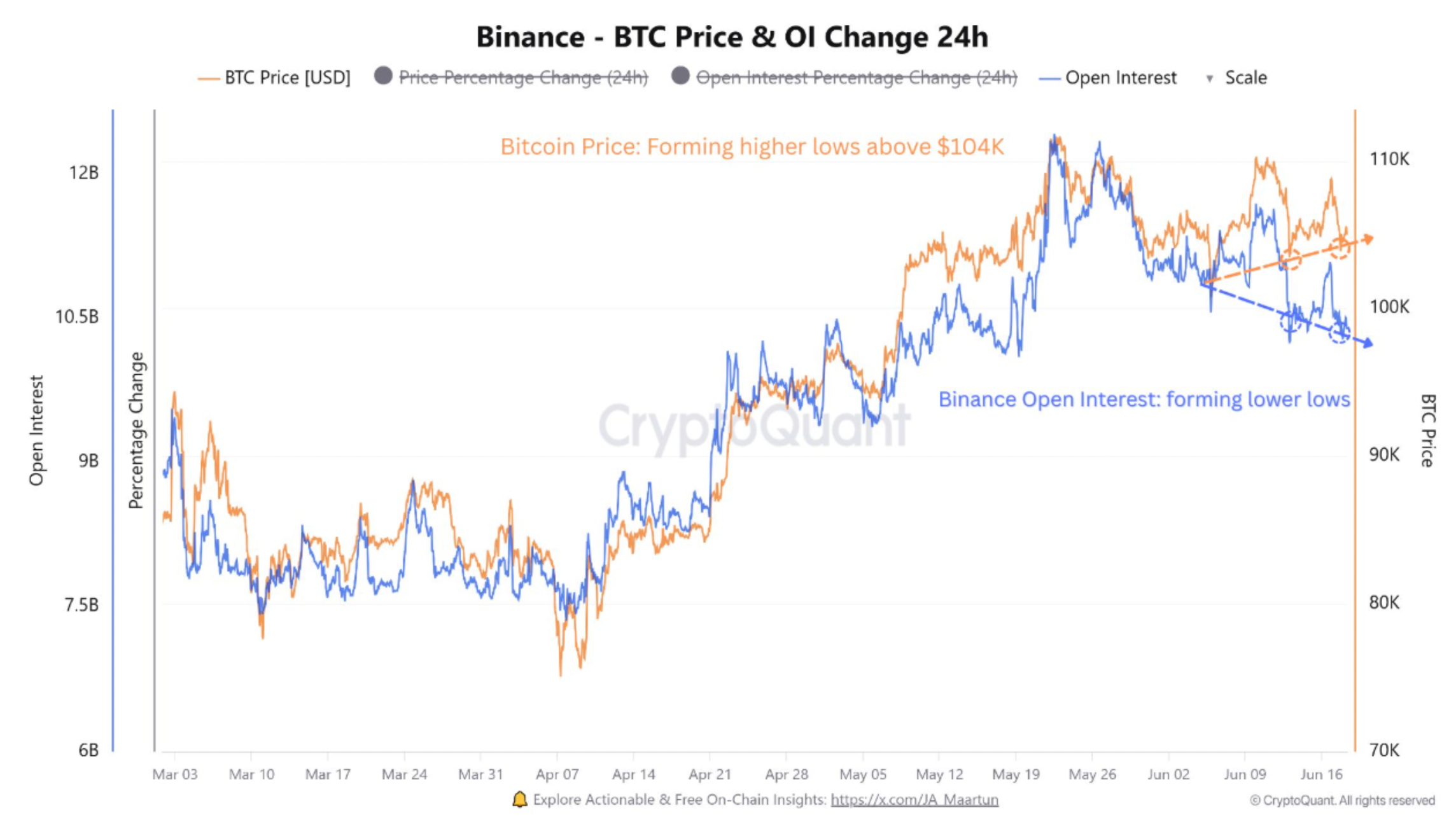

The following chart – titled Binance BTC Price and Open Interest Change – illustrates how this price area has repeatedly absorbed strong selling pressure, resulting in BTC forming consistent equal lows just above $104,000.

In contrast, open interest on Binance has formed a series of lower lows, indicating progressive deleveraging in the derivatives market. Deleveraging typically reduces excess risk and can help build a more stable foundation for sustainable price growth.

Additionally, the $104,000 level has acted as a “liquidation magnet” for late long positions. The following BTC: Binance Liquidation Delta chart shows a sharp concentration of liquidations around this price level.

Green delta spikes in the chart represent the forced closure of long positions, suggesting a cleanup of traders who joined the rally late. Minimal short liquidations confirm that the market was dominated by long squeezes.

To explain, a long squeeze occurs when the price of an asset drops sharply, forcing traders holding long positions to sell or get liquidated. This selling pressure pushes the price down even further, often accelerating the decline.

Interestingly, the timing of this market cleanup coincides with the Fed’s decision to pause interest rate hikes. Such a development has typically worked out as a net positive for risk-on assets like BTC. Taha concluded:

Historically, BTC has shown bullish tendencies following rate stabilization, especially when paired with signs of liquidation exhaustion and fading open interest.

BTC Uptrend To Resume Soon?

Multiple on-chain indicators suggest the current BTC pullback may be nearing its end. For example, recent analysis by crypto analyst CryptoGoos points to short-term BTC sellers running out of momentum.

Moreover, signs of retail euphoria remain absent, hinting that the market may still be in an early or mid-stage rally. The Puell Multiple also suggests that BTC has further room to grow.

That said, some cautionary signs remain. Notably, BTC trading volumes across major global exchanges have dropped to multi-year lows, raising concerns that bullish momentum may be weakening. At press time, BTC trades at $104,274, up 0.3% in the past 24 hours.