Bitcoin is once again at a critical juncture after reclaiming key levels above the $105,000 mark. Over the weekend, BTC experienced extreme volatility triggered by the US military’s strike on Iran’s nuclear facilities, sparking panic across global markets. However, yesterday’s announcement of a ceasefire between Israel and Iran brought relief, fueling a sharp recovery in Bitcoin’s price.

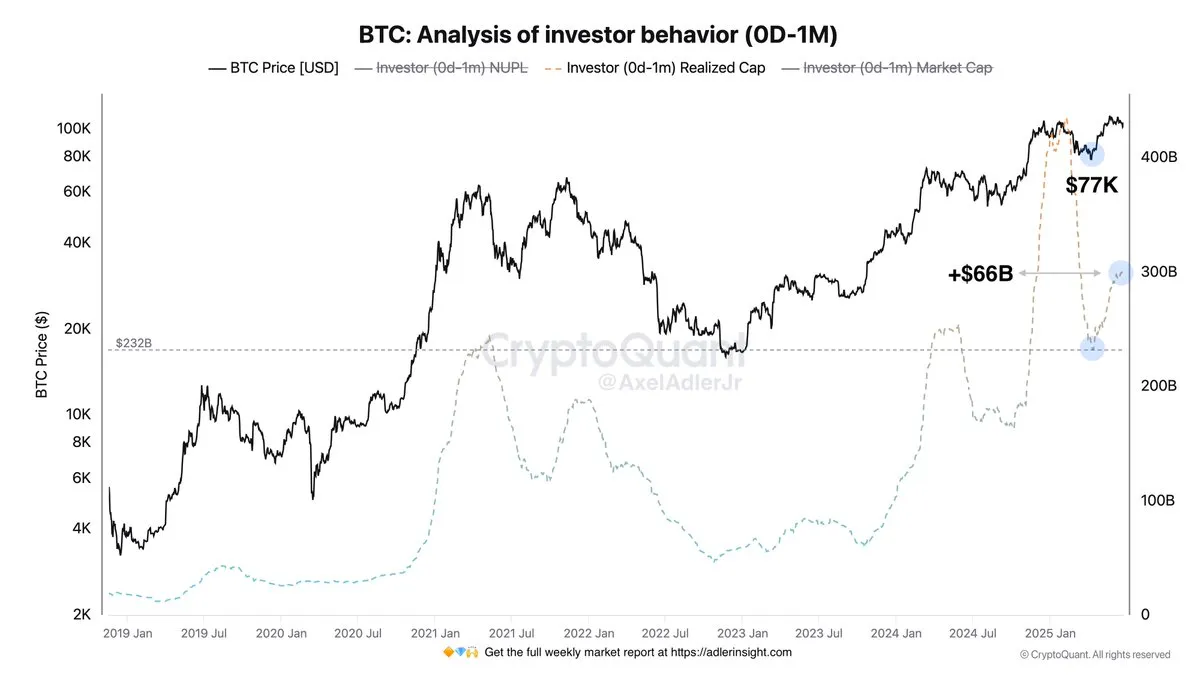

This week is expected to be decisive in determining Bitcoin’s short-term trajectory. While bulls have managed to regain control in the near term, uncertainty remains elevated due to global tensions and macroeconomic headwinds. On-chain data from CryptoQuant provides further insight into current market dynamics. Since mid-April, the Realized Cap of the 0–1 month age cohort has surged by $66 billion.

Despite this selling pressure, Bitcoin has held within a narrow range, suggesting that demand is strong enough to absorb recent profits. If bulls can build on current momentum, Bitcoin could be setting the stage for its next major move. All eyes are now on whether BTC can push beyond $109K to retest all-time highs.

Bitcoin Consolidates As Market Absorbs Profit-Taking Pressure

Bitcoin recently faced intense volatility, plunging to $98,000 before staging a sharp rebound above the $105,000 mark. This recovery comes amid growing concerns about a potential double top formation, which has fueled bearish sentiment among market participants. Despite this psychological pressure, on-chain data continues to show a resilient market structure with no major warning signs of an imminent collapse.

According to top analyst Axel Adler, since April 13, the Realized Cap of the 0–1 month age cohort has increased by $66 billion. This metric reflects significant profit-taking activity from short-term holders who entered positions during the rally. Approximately 720,000 BTC have been sold during this period, adding substantial supply pressure to the market.

However, what’s notable is how Bitcoin has managed to absorb this selling volume without collapsing. Prices have remained largely within a narrow consolidation range, suggesting that buyers are stepping in to match the outflow. This kind of accumulation often signals strength beneath the surface, even when price action appears uncertain.

The broader market is now watching closely to see whether Bitcoin can maintain momentum above $105K and push toward retesting the $109K–$112K resistance zone. Until then, consolidation remains the dominant trend, potentially a calm before the next major move.

BTC Tests Resistance After Reclaiming $105K

Bitcoin’s 4-hour chart shows a strong rebound from the $98,000 lows, with the price currently hovering around $105,300. This move follows a sharp surge in buying momentum that pushed BTC above the key $103,600 support-turned-resistance level. The reclaim of this level, combined with a decisive close above the 50 and 100-period moving averages, signals renewed bullish interest.

Volume has also spiked significantly during the latest bounce, indicating real market participation and not just a short squeeze. However, BTC is now approaching a major confluence zone between $105,500 and $106,000, where the 200-period moving average and a recent horizontal resistance zone converge. This range has acted as a rejection area several times in June, and price action here will determine if BTC can aim for the next resistance at $109,300.

Until BTC breaks above $106K with strong volume, the broader market structure remains neutral to slightly bullish. The higher low formed during the bounce from $98K gives bulls some confidence, but confirmation will come only if price consolidates above the 200-MA and pushes toward the May highs.

Featured image from Dall-E, chart from TradingView