- Current Price: $0.173

- Weekly Decline: ~30%

- 24-Hour Liquidations: $22 million

- Total Liquidations Last Week: $78 million

Market Sentiment:

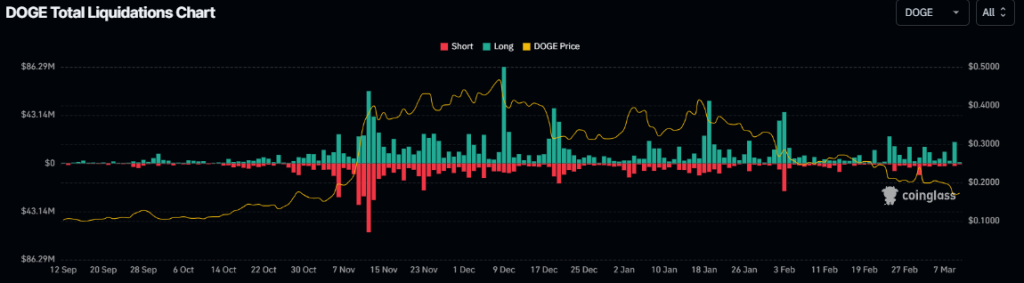

The Dogecoin market has been shaken by a substantial 30% price drop last week, leading to a wave of liquidations. Over the last 24 hours, liquidations have totaled $22 million, and $78 million in the past week, according to CoinGlass data. This significant selling pressure has caused Fear, Uncertainty, and Doubt (FUD), further depressing investor sentiment and increasing the likelihood of further price drops.

Dogecoin liquidation chart last 24 hours. Source: Coinglass

DOGE total liquidation chart. Source: Coinglass

Technical Outlook:

- 100-Week EMA: DOGE closed below its 100-week Exponential Moving Average (EMA) at $0.173, signaling bearish momentum.

- RSI (Relative Strength Index): The RSI has dipped below 50, indicating further weakness and increasing bearish pressure.

- MACD (Moving Average Convergence Divergence): The MACD crossover suggests a continuation of the downtrend.

Price Forecast:

If the correction continues, DOGE may test its November 3 low of $0.142. However, if the price recovers above the $0.181 level, there’s a potential for a rebound toward the $0.220 resistance.

In summary, the Dogecoin market is currently under significant pressure, and the outlook points to further downside risks unless a recovery above key levels can be achieved.