As the upper chamber of the US Congress prepares its version of a market structure framework, Republican Senator Cynthia Lummis recently told CNBC that she hopes the Senate and House of Representatives can soon find a path to pass both crypto bills moving through Congress.

Senate Releases Crypto Market Structure Principles

Discussing the Senate’s efforts to develop its version of a market structure bill, Senator Cynthia Lummis highlighted the need to pass crypto legislation quickly. Over the past few weeks, the Senate Banking Committee has been working on the principles for market structure legislation, having its first related hearing on Tuesday.

During the hearing, led by Senator Lummis, the Senate Banking Committee heard “loud and clear that the United States needs to pass market structure now,” explained Lummis, adding that one of their witnesses affirmed that the legislation needed to be passed by “yesterday.”

The Republican senator explained that without a framework, companies have been regulated by the Securities and Exchange Commission (SEC), which led to the previous administration’s “regulation by enforcement” approach. This has cost crypto firms millions of dollars in lawyer fees, and didn’t offer any certainty about the future.

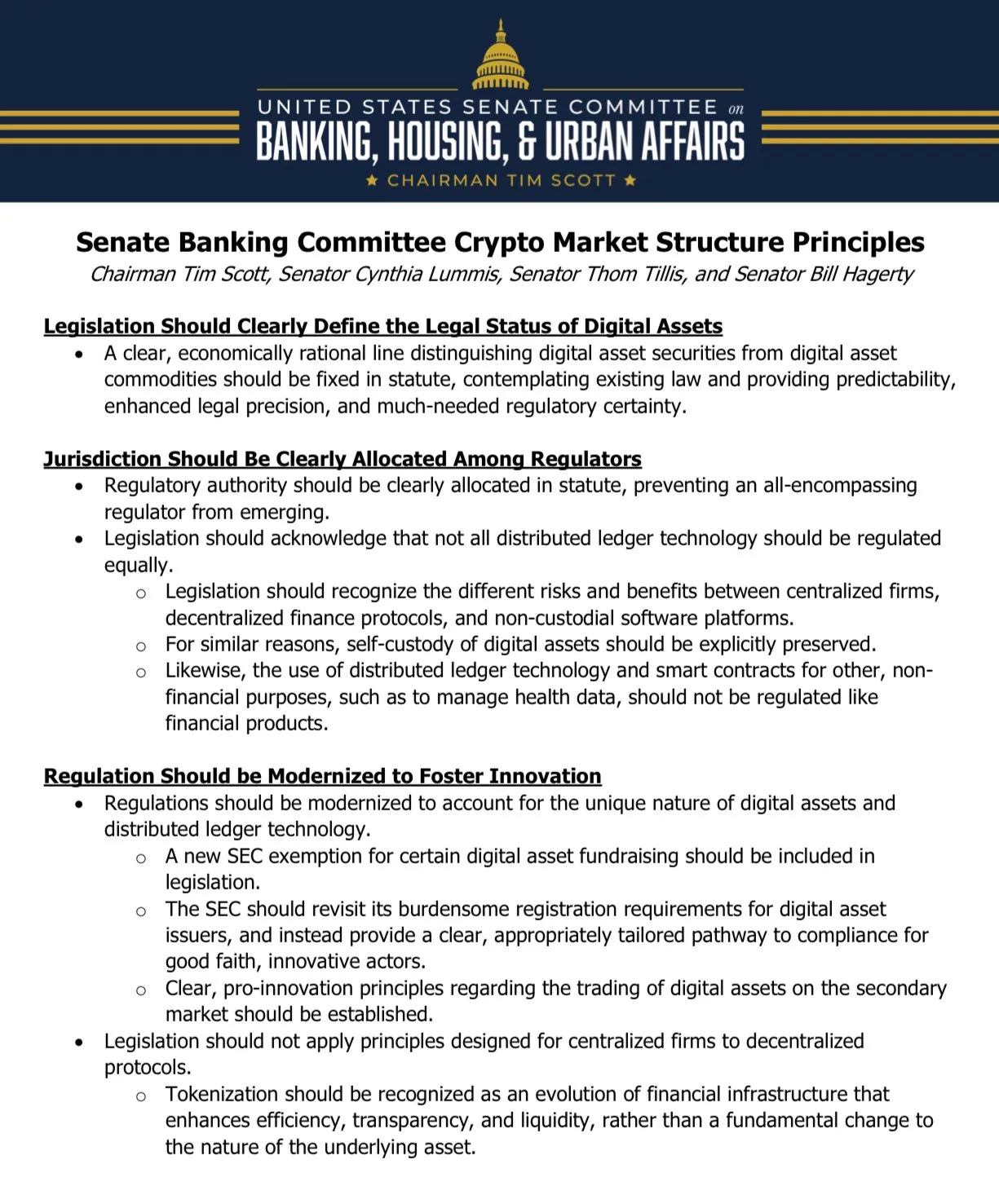

Lummis also detailed that they are “just putting out a framework of principles” that can be followed, while they work out the details on the legislation. Notably, the Senate Banking Committee released the market structure principles, detailing the focus of the discussion draft on the bill on Tuesday.

The document, signed by Senators Lummis, Thom Tillis, Bill Hagerty, and the Committee’s chairman, Tim Scott, outlines six core principles for the upcoming crypto bill. The list stated that legislation should clearly define the legal status of digital assets, providing predictability, enhanced legal precision, and regulatory certainty.

Additionally, jurisdiction should be assigned among regulators, with the regulatory authority being clearly allocated in statute to prevent an “all-encompassing regulator from emerging.”

The principles also suggest that regulation should be modernized to foster innovation while protecting investors and traders, adding that federal financial regulators should welcome responsible innovation.

Journalist Eleanor Terret revealed that early feedback from the Decentralized Finance (DeFi) community members “suggests the Senate’s market structure principles were very well received.”

House To Vote For GENIUS-CLARITY Package?

Senator Lummis also discussed the future of the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which passed a full floor vote 68-30 last week and was received by the House of Representatives on Monday.

She shared her hope that both chambers of Congress can work together to “figure out a path forward” for the Digital Asset Market Clarity (CLARITY) Act and the GENIUS Act, adding, “I’m not saying combine them, but they both need to pass this year.”

However, the Senate’s bipartisan efforts to get the bill to US President Donald Trump’s desk could have hit a wall in the lower chamber, as House members are reportedly pushing to package the crypto bills together.

As reported by Bitcoinist, some lawmakers consider that merging the two bills increases the odds of both clearing the House of Representatives before the early August deadline.

In a Tuesday statement to Punchbowl News, Majority Whip Tom Emmer affirmed that the House will vote on the stablecoin-centered bill if the legislation is combined with the market structure bill.

“I expect the GENIUS Act has a path in the House, so long as it’s accompanied by the CLARITY Act,” Emmer stated.

Meanwhile, journalist Emily Wilkins reported that House Majority Leader Steve Scalise said that no decision has been made on whether the House should vote on its version of the stablecoin bill, the STABLE Act, or the Senate’s version, as President Trump suggested.

However, Scalise gave “some weight to Hill’s plan to do both stablecoin and market structure at once, saying it’s what the crypto industry wants.”