Massive ETH Withdrawals from Exchanges

Over the past ten days, investors have withdrawn approximately 900,000 ETH from exchanges, valued at around $2.5 billion at current prices. Such large outflows often indicate accumulation by investors and reduced selling pressure, which is typically considered a bullish signal for the market.

Ethereum Supply Trends

Following the Merge upgrade in 2022, Ethereum transitioned to a Proof-of-Stake mechanism, initially leading to a declining ETH supply. However, since April 2024, this trend has reversed. The supply started increasing after the Dencun hard fork, raising concerns about Ethereum losing its deflationary nature.

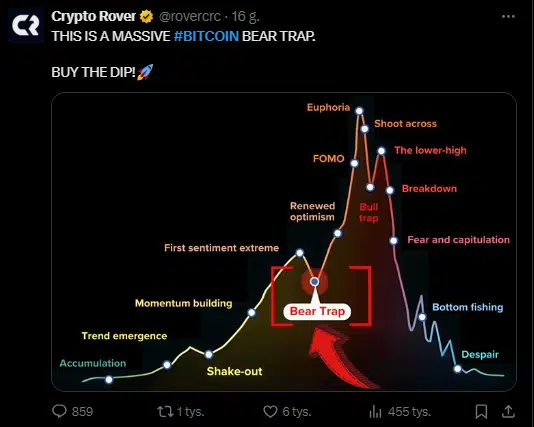

Impact on ETH Price

- In November 2024, Ethereum’s price peaked at $4,000 before a correction.

- By February 2025, it dropped to $2,200, rebounded to $2,468, but is now fluctuating around $2,200 again.

- Analysts suggest Ethereum needs more time for consolidation, with the next major upward move likely in May 2025.

Conclusion

Recent data highlights significant market shifts in investor behavior and Ethereum’s supply. While large withdrawals from exchanges could signal accumulation and potential price increases, the rising ETH supply following recent upgrades might slow down its long-term growth. Investors should closely monitor these factors to make informed decisions.